A review of William A. Allen, Monetary Policy and Financial Repression in Britain, 1951-59. Basingstoke, UK: Palgrave Macmillan, 2014. xii + 287 pp. $120 (hardcover) ISBN 978-1-137-38181-5.

This was originally published on EH.Net, owned and operated by the Economic History Association

William Allen has researched and written a fascinating and valuable review of monetary debates in an era normally associated only with fiscal policy. Two thirds of the book details events, beginning with a review of the position inherited from the Labour Government and ending with Harold Macmillan’s General Election victory in 1960. Then more discursive chapters follow up relevant issues on the technique, management and communication of monetary policy, as well as a look to the future. The book includes detailed and useful tables of economic statistics (though the charts are not well done).

Allen seems dissatisfied with the conventional narrative, but his position throughout betrays a deep conservatism on monetary theory and policy. Ultimately he avoids or is unable to see bigger questions, only in this does the book fall short as a document of this period.

Allen reminds us of the (generally ignored) central role for cheap money policy under the Labour Government, involving the continued decommissioning of Bank rate and aiming debt management policy at securing low rates of interest on government bonds of all maturities. In many ways his story is of how the Bank of England, and in particular Governor Cameron Cobbold (“the dominant influence on domestic monetary policy, by virtue not of his office but of his willingness to lead and the absence of competition” p. 194) re-asserted control over monetary policy, and the contests throughout the 1950s with their changing political masters, albeit ones from the same political party. There were repeated tensions around Bank rate, quantitative controls on lending, the long-term rate of interest, and government spending and taxes. Below is a stylized account of Allen’s story.

Labour’s period of office ended with Cobbold agitating for a rise in Bank rate given inflationary pressures arising from the Korean War; Hugh Gaitskell refused and instead asked that the Bank use quantitative controls over the volume of bank lending. In spite of the nationalization, under the Act of 1946 the Government was apparently not able to force the Bank to give directions to commercial banks.

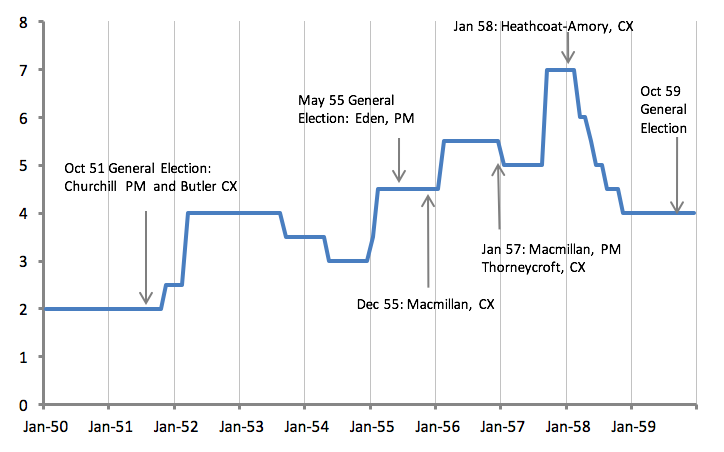

When the Conservatives took office in October 1951, they discontinued the cheap money policies that Butler later described as Labour’s “Ark of the Covenant” (p. 16). Claiming they had inherited an overheating economy, Cobbold was allowed his way: after only ten days, rates rose to 2.5 percent — the first rise for 20 years.

Bank rate and political events, 1950-1960

Whether the economy was overheating is unclear. Gaitskell had acted responsibly to restrain demand, making the spending cuts that arguably lost the election. Allen concedes, “Labour had maintained tight fiscal policies from 1948/49 to 1950/51 explicitly in the interests of containing inflation; it did not regard inflation as a target for monetary policy” (p. 41). Arguably if the economy was overheating it was because the Bank refused quantitative control.

The Bank also began to dismantle other procedures integral to Labour’s policies. For example, they stopped pegging the Treasury bill rate at 0.5 percent, which was pre-requisite for the reactivation of Bank rate. And they began to drive up the long-term rate of interest, initially by “forcing funding” (p. 26). Allen notes that along the way they greatly angered discount houses (p. 29). Likewise the Cambridge economists, “[Richard] Kahn and [Joan] Robinson, who were among the leading Keynesians of the time, were hostile” (p. 31). Though note the U.S. Treasury–Federal Reserve Accord of March 1951 amounted to a statement of intent on a global basis. With a second rate rise to 4 percent, “there was barely any economic growth in 1952” (p. 39) and inflation was no more.

The Bank motivated the subsequent relaxation of monetary policy, with the Treasury more cautious. Cobbold (throughout) appealed to exchange rather than domestic economic conditions, seemingly preferring a new variant of the imagined mechanical regime and thinking that had so decisively failed in the 1920s. With domestic demand removed from the policy narrative, they could also maintain the customary pressure for fiscal restraint. But the Conservatives acted to “ease fiscal policy” and introduced investment allowances in the 1954 budget “so generous as to amount to a subsidy” (p. 42).

Over the next three years Bank rate would be raised from 3 to 7 percent, with only a brief hiatus. Allen labels events of 1955 a “debacle”: Churchill’s accommodation of wage demands is blamed for renewed inflationary pressures. The Bank deployed a weakening of sterling as justification for the next round of rate rises. In February and March ahead of the 1955 General Election the Bank put up rates first by0.5 percent and then by 1 percent. Allen cites Anthony Seldon blaming Churchill and Eden for the expansionary Budget in April 1955 (p. 74). He also dismisses evidence from Robert Hall (chief economic adviser to the Treasury) maintaining that the Bank did not suggest to Butler that their monetary action would be insufficient.

After the election, a second Budget reversed the pre-election stimulus. Gaitskell’s remarks are cited: “having bought his votes with a bribe, the Chancellor is forced – as he knew he would be – to dishonour the cheque” (p. 83). Three months later in December 1955 Butler “left the Treasury”; Allen cites the following remark: “he was a poor Chancellor and would probably have made a poor Prime Minister” (p. 110, n. 7). His successor Harold Macmillan faced another round of tightening as well as further moves on the long rate to 5%. There were more confrontations on quantitative control (Cobbold’s speaking notes include the contemptuous “Change of bowling most necessary” (p. 94). GDP growth reverted to the doldrums. Against this backdrop the Radcliffe Committee was announced as an internal review in the April 1956 budget. Skeptical at first, Cobbold welcomed the report “as well he might have done. It largely reflected his views” (p. 107). The Committee did not address the real matter of substance: the ending of cheap money.

From the point of view of monetary policy, the Suez crisis took Macmillan to Downing Street and Thorneycroft to the Treasury. Allen approves the new Treasury appointments as “men with a mission” to control inflation (p. 114). But he is very critical when next the Bank controversially promoted a rate cut, though staying true to form on government spending.

Events then took the routine course, more refusal to entertain credit control, then an exchange crisis. This time Cobbold called for and got (on 19 September 1957) a “drastic” increase to 7 percent, way out of line with other countries. There was, however, finally progress of quantitative controls, with a (albeit short-lived) ceiling on bank advances.

Unsurprisingly, the economy was hit. Macmillan and his adviser Roy Harrod — under-rated as an intelligent follower of Keynes — championed reflation from Downing Street. It seems Thorneycroft was not on message and was replaced by Derick Heathcoat Amory. Rates were cut quickly and the 1959 budget was expansionary. The election was won by the Conservatives, and the author leaves the story unhappy about the inflationary predicament that was about to come to pass (though certainly not in wages increases, which averaged 4 percent a year over the next five years).

As the above might indicate, Allen’s account is warts and all. At the end of the book he is also severely critical of the academic approach to monetary theory throughout the post-war period. “Academic debates therefore did not inform the practice of monetary policy,” with a “divorce between theory and reality [that] persisted for many years” (p. 213). He justly absolves certain academics, Richard Sayers and Roger Alford at LSE, and later Victoria Chick and Sheila Dow. But emphasizes that these “institutional monetary economists are not in the mainstream,” and records Charles Goodhart’s remarks that to take such an approach was “sufficient to cast his/her reputation into outer darkness” (p. 217, n. 37).

But Allen’s own prejudices on the supreme achievement of the present inflation targeting regime, for me, blind him to deeper considerations. The Labour Government attempted to reverse the place of the monetary system in the economy — as servant not master, under public not private authority. In a footnote Allen recognizes “it would be wrong to identify the ‘Keynesian model’ which became the standard method of economic analysis, at least until the late 1960s, too closely with the work of Keynes himself” (p. 35, n. 38). But he will not concede that the Labour Government was following the same work. His rationale for their approach (pp. 6-7) does not mention the paramount importance to private investment and hence employment of permanently low interest rates (Tily, 2010). Nor under the General Theory is full employment inherently inflationary: the Philips Curve is a Keynesian device.

The Bank of England restoration of dearer money was an explicit challenge to policy aimed at full employment. Its refusal to consider quantitative controls (and the discontinuing of Treasury deposit receipts), likewise. There is likely much to the Treasury view that “Cobbold was trying to prevent the adoption of monetary policies which he disliked by pretending they were impracticable” (p. 93). Inflationary tensions emerged as the Conservative Governments over this period refused to go wholly along with a new policy on interest rates that was opposed to full employment. Though obviously they were culpable for yielding to Cobbold in the first place. Allen concludes on the present monetary situation. Ironically, of course, quantitative measures are now all the rage. But the real need is to re-assess present outcomes in the light of the restoration of dear money that began some 65 years ago, and to stop pretending that long rates are subject only to natural forces (Tily, 2015).

References:

Tily (2010) Keynes Betrayed, Palgrave Macmillan.

Tily (2015) “The long-term Rate of Interest as Keynes’s ‘Villain of the Piece’,” review essay of “Long-term Interest Rates: A Survey,” The Council of Economic Advisers (2015), Real-world Economics Review, 73. http://www.paecon.net/PAEReview/issue73/Tily73.pdf

Geoff Tily is Senior economist at the UK Trades Union Congress.

Copyright (c) 2016 by EH.Net. All rights reserved. This work may be copied for non-profit educational uses if proper credit is given to the author and the list. For other permission, please contact the EH.Net Administrator ([email protected]). Published by EH.Net (July 2016). All EH.Net reviews are archived at http://eh.net/book-reviews/