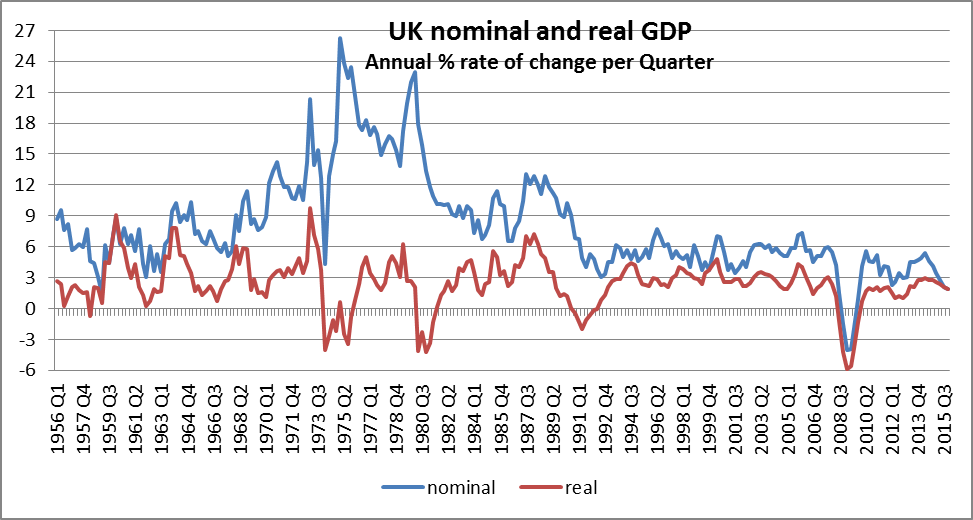

We’ve just seen something that has not been seen for 55 years – two successive quarters in which nominal (current price) GDP in the UK has been no higher – in annual percentage terms – than real (chained volume, i.e. allowing for inflation) GDP.

Today, ONS published its second estimate of GDP for the 4th Quarter of 2015. The annual rate of change (compared to Q4 2014) was 1.9% for both real and nominal GDP. In Q3, the real and nominal rate of change was 2.1%. Identical in both quarters.

We have to go back to 1959/60 to find a similar case. True, in Q4 of 1999, there was a single moment when real and nominal came together – in that case at 3.7% – but that was ephemeral.

Back in 1959, in Q3 real and nominal GDP were tied at 4.4%, but in Q4, nominal GDP edged ahead – 7.1% annual increase, compared to real GDP at 7%! Then in early 1960, we saw the only 2 months since records began (in 1956) of 2 successive quarters in which real GDP was higher than nominal, though with both rising at a very rapid pace.

In Q1 1960, nominal GDP rose by 8.8% (annual rate), while real GDP was up by 9.1%.

In Q2 1960, nominal GDP rose by 6.3%, while real GDP was up by 6.5%.

From then on, things returned to the usual pattern.

What is notable about the current two-quarter “tie” between nominal and real rates of annual change, therefore, is that it reflects an economy that is simultaneously decelerating and on the edge of deflating, whereas in 1959/60, the economy was also close to deflation, but GDP was racing ahead.

We also learnt today from ONS that business investment declined, between Q3 and Q4 2015, by 2.3%, and the annual rate of increase in Q4 was only 2.4%. This reinforces the impression of an economy which, despite some hotspots (retail, real estate, some business services), has been slowing over the last year. The OBR’s optimism – displayed to the Chancellor’s political advantage for the Autumn Review last November, seems maybe a little… optimistic.