PRIME has looked at the most recent Eurostat figures to see whether, for all EU countries, there is any meaningful correlation between top income tax levels and unemployment rates. We have also drawn up the European ‘league table’ of employment protection from the data of the Organisation for Economic Cooperation and Development (OECD), and compare this with unemployment rate rankings. Among PRIME’s conclusions:

there is no evidence from these comparisons that higher top rates of income tax are correlated with higher rates of unemployment

the UK has the lowest overall employment protection in the EU, but this does not correlate to a lower comparative level of unemployment

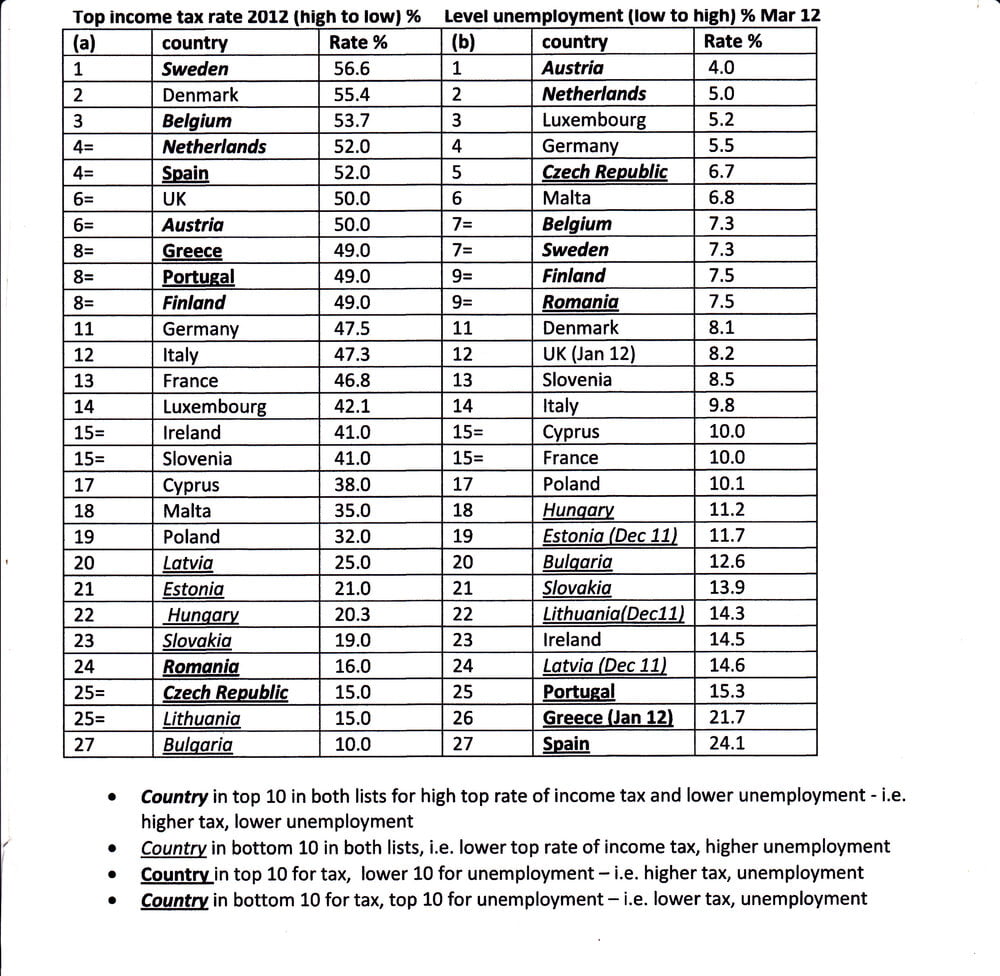

We have first ‘ranked’ countries by reference to (a) their top rates of income tax, and (b) their recent (mainly March 2012) unemployment rates.

One set of countries comes out as having a high ‘top’ level of income tax (49+%), whilst having a relatively low rate of unemployment (under 8%). These are Austria, Belgium, Finland, Netherlands and Sweden.

A second set of countries has a low ‘top’ income tax rate (35% or less), whilst having a relatively low unemployment rate (under 8%). These are the Czech Republic and Romania.

A third set has a low ‘top’ income rate, whilst also having a relatively high unemployment rate. These are Bulgaria, Estonia, Hungary, Latvia, Lithuania, and Slovakia.

A fourth set has a high ‘top’ rate of income tax, and a higher level of unemployment. These are Greece, Portugal and Spain.

Our conclusion from this – having a higher indeed a lower ‘top’ level of income tax does not appear to be correlated with levels of unemployment in any meaningful way. Depending on many other factors, a country can have a high top rate of income tax and a lower unemployment rate, or the opposite. The ‘right’ top rate of tax is a political choice for each country, with no a priori ‘correct’ answer from economists.

The UK, with the current (but to be reduced) top tax rate of 50% comes out at 6th=, whilst our rate of unemployment (using January 2012 UK figures, the latest in the comparative Eurostat table) was 12th out of 27.

Here are the tables and figures, taken from Eurostat:

tax and unemp rates table

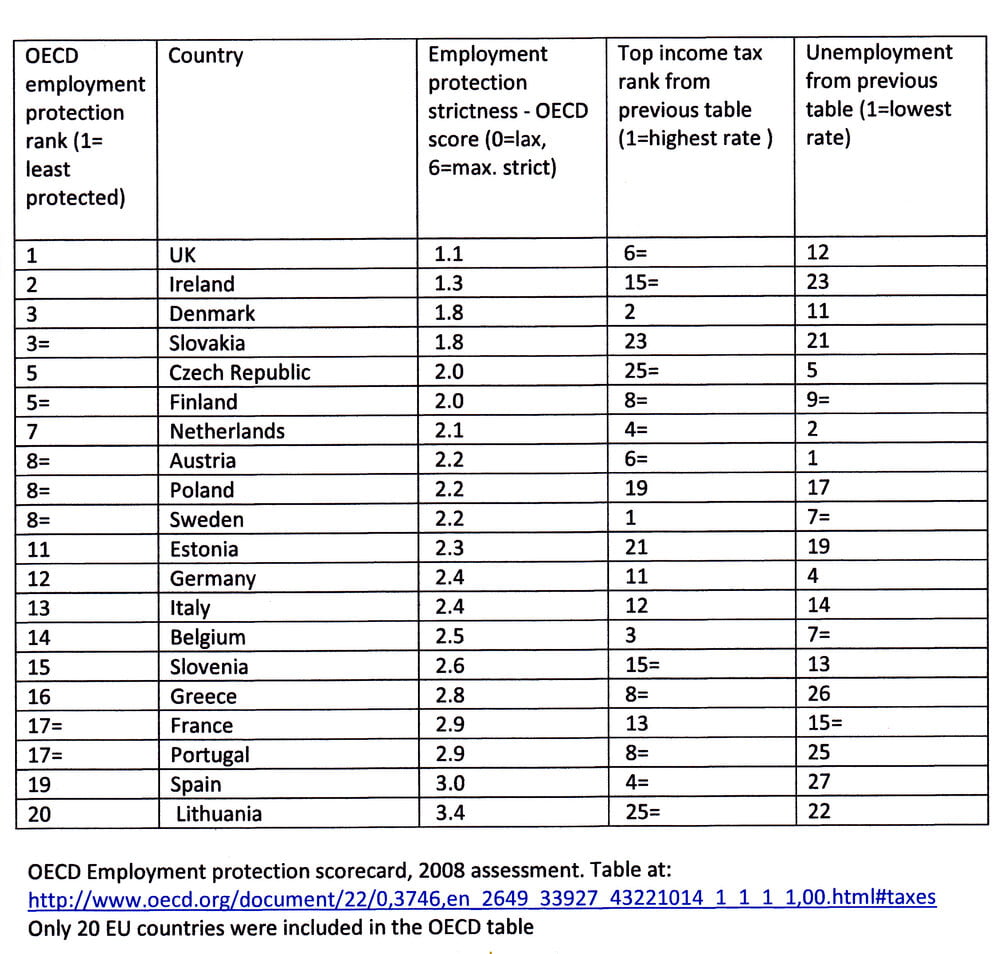

Next, we have looked at the OECD table giving its ‘scorecard’ assessment (as at 2008) of the overall level of employment protection, where 0 = no protection, and 6 = extremely protected. Also included for ease of comparison are the countries’ rankings for income tax top rates and unemployment, from the previous table. Since the latter data are from 2012, the comparisons are indicative only, though overall employment protection systems are unlikely to have changed greatly in most countries.

Again, from the above statistics, there is no clear pattern that emerges between rankings by level of employment protection, by level of unemployment, and by top levels of income tax.

Here is the table showing the rankings, from the OECD scorecard:

employment protection from oecd table

There is no observable correlation among EU member states between higher top rate of income tax and rates of unemployment

There is no clear correlation shown between the degree of employment protection (per the OECD) and current rates of unemployment, and different sets of countries show different pattens (see below)

The UK has long had the lowest level of employment protection amongst all EU countries, from the OECD data, but only the 12th “lowest” unemployment rate at January 2012.

Compared to the UK, Germany – the EU’s strongest performing economy of recent years – has a higher overall level of employment protection and a lower rate of unemployment. Its top income tax rate, at 47.5%, is slightly lower than the UK’s 50%, but higher than the level of 45% which is to be reintroduced in the UK.

Some countries combine a relatively higher level of employment protection with high rates of unemployment (e.g. Spain, Greece, Lithuania), but for example Ireland combines a low level of employment protection (and a lower top rate of income tax) with one of the highest rates of unemployment

Several other comparable countries of northern or central Europe (Sweden, Denmark, Netherlands, Austria) have a higher overall level of employment protection than the UK, combined with relatively high top rates of income tax, and lower current rates of unemployment.

9 Responses

This article is a bit wrong. Work taxation in some countries does not stop with the income tax. There are some other taxes that adds to that. For Romania the state takes around 45% of what the employer has to pay.

Typo in my last post – that should read …a positive one (correlation) between HIGHER TOTAL TAX TAKE and % OF POPULATION IN WORK”

Health warning I am not a statistician and I can’t check that the relationship I perceive has any statistical validity. However I normally believe the evidence of my eyes.

There IS a correlation, I think, but not between HIGH tax rates and unemployment, it is a positive one between HIGHER TAX and Employment.

In the OECD countries if you map tax/gdp % against workers/population % the trend line lines slope in the same direction. Ranking by % in work, the tax/gdp points scatter above and below the line, but there is a distinct upward trend.

There’s no obviously direct mechanistic irrefutable linear relation (though that may exist if other factors were built in) , but in such complex systems all sorts of causality may be at work – populations intelligent enough to recognise the value of social spending are also intelligent enough to create jobs for themselves, perhaps, or maybe some effect via general education.

[…] Simply put, there is no correlation. But the Chancellor is hell bent on making the UK a low corporation tax country. Putting us in a position where Korea and Indonesia will have higher tax rates than us… Seriously? We’re supposedly struggling to bring the deficit down, and yet we’re making ‘low tax countries’ look like Socialist states… […]

[…] Not only does he put out the same tired excuses about the 50p tax rate not raising any money (HMRC estimated £3 billion in revenues – more would be possible if tax loopholes were closed) but he also makes the astonishing claim – with no evidence – that the higher rate of tax would result in job losses. Sorry, George, but there is no evidence for a even a correlation between higher taxes and lower employment. […]

When making comparisons using tax rates I think using an effective rate would be a more useful measure. This reflects the $$ actually sent to the government. Maybe other information would be helpful as well. Regulations, fees, sales taxes, minimium wages are all “taxes” but are not included in this discussion. To answer the question who spends our money more effectively the Government or the people we must consider all the inputs.

Jay, you would do well to check your facts before launching into an insult-heavy comment such as this. But let me respond on a factual basis.You can find the employment rate figures for 2011 and previous years from Eurostat athttp://epp.eurostat.ec.europa.eu/tgm/table.do?tab=table&language=en&pcode=tsdec420&tableSelection=3&footnotes=yes&labeling=labels&plugin=1

You will find, for example, that Ireland has a 2011 employment rate of 64.1%, whilst Portugal’s is 69.1%. Ireland and Portugal both have very high unemployment, but Ireland scores 2nd lowest (after the UK) on employment protection, and is in mid-table for highest rate of income tax. Poland has an employment rate in 2011 of 64.8% but is only 2.2 on the employment protection scorecard, i.e. below the 2.5 you cite.

Here are the 2011 employment rates for the countries you cite:

Greece 59.9%

France 69.1%

Spain 61.6%

Portugal 69.1%

And here are their employment rates for 2008, i.e. at peak before the crisis:

Greece 66.5%

France 70.4%

Spain 68.3%

Portugal 72.6%

Ireland was 72.3% in 2007. So the crash in most of these countries not only caused high unemployment, but also shows a strong correlation with a declining employment rate.

Obviously you are some hard left loon who wants higher taxes so you can give money to your friends. Bankers, union bosses etc.

Greece, France, Spain and Portugal have the lowest employment rates in the developed world, and ALL have over 2.5 in job protection.

The countries under 2.5 have higher employment rates, more people working.

Even after Gordon Browns cedit crunch, socialism again pah, the UK and Ireland STILL has higher employment rates than any southern european country.

The BBC might hire you within the week, a 6 figure salary on the back on exploitng single mums, socialism again pah.

Switzerland has the highest employment rates ever record, 80% of adults working. They have very low taxes at every level. So the smaller countries in europe are falling behind Switzerland because of higher taxation and being in the EU.

Oh and the further northern in europe you go, the less people on benefits, UK aside, and the more open markets.

Scandanavia has a 12 month cap on benefits.

i’ll assume you’re from the US…

bankers and union bosses, huh?

wait… who are the top 5 contributors to the romney campaign?

http://www.opensecrets.org/pres12/