Balanced Budget Target

The successfully long-running medicine show of Chancellor George Osborne seems at last to have hit the buffers, over-burdened by banal rhetoric, missed targets, and ever-more blatant pandering to the rich. Outrage, even by Tory MPs, at the Chancellor’s trade of disability support for high-earner tax cuts revealed the rotten core of his austerity project.

Along with many others I have demonstrated that expenditure cuts represent the least effective – as well as the most inequitable – method of deficit reduction. The Chancellor himself has proved this for all to see. At the end of his first full year in office (April 2011) overall annual borrowing was £139 billion, compared to £80bn now, almost five years later. Simple division reveals a monthly reduction of one billion. At that pace the deficit would close in September 2021, after over 11 years of Osbornite austerity (though events of recent weeks suggest that Mr Osborne may not be implementing policies through that date).

A flaw more basic than tardiness resides in the rhetorical obfuscation of the austerity propaganda. The fundamental flaw is the belief that policies exist capable of maintaining a balanced budget over an extended period. Doing so is at best improbable and trying to do so diverts from the serious job of fiscal management. The fiscal balance is the indirect outcome of other policies, not a policy in itself.

The critique which follows might be countered with the argument that no one designs policies to achieve an exact balance, [revenue – expenditure = 0]. Rather, the goal is for a government to stick close to it over time, while knowing it is not possible continuously to hit it spot-on. That faux defence misses the point my argument. The critique that follows applies to all budget targets be they a zero balance or, for example, the Maastricht 3%. It also applies to every measure of the fiscal balance (overall, primary and current), and to any time period specified for the target.

Seductively Sensible

Most politicians – and much of the public – believe that commitment to match public revenue with public expenditure represents a sensible, sound and achievable fiscal policy. This might be termed the Fiscal Balance Goal (FBG). Within the consensus considerable disagreement exists over 1) when and how rapidly to achieve it, 2) what specific measure of the budget requires balancing, and 3) what policies the government should apply to bring the balance about.

We should not throw all FBG supporters fall into the same camp. On the contrary, obsession to the point of lunacy characterises the aggressive George Osborne version – all deficits are bad; they should be eliminated as quickly as possible; public revenue must cover total spending; and expenditure cuts, never tax increases, are the appropriate method.

This deficit fetish makes all public policy captive to hitting the zero deficit target or overshooting into surplus. Until recently the Chancellor’s repeated failures and inconsistencies seemed not to weaken the grip of this madhouse version of the FBG over the public mind and the media.

Even the putatively sensible Institute for Fiscal Studies focuses on the minutiae of the Osborne fiscal outcomes, rather than ringing the bell on the madness of the policy as a whole. Even worse, the Chancellor suffers criticism for not achieving a target that would provoke recession if he did. The responsible approach to this fiscal mismanagement is not to meticulously re-calculate the likely success of reaching the Osborne fiscal target, but to label it for what it is, pernicious nonsense.

The ideological absurdity of the Osborne FBG does not taint all versions. Gordon Brown’s “golden rule”, that the government should borrow to invest but not for current expenditure, could be defended as adhering to the guideline that borrowed funds should be used to produce a return, in the form of a flow of revenue (e.g. a toll bridge) or flow of public services (e.g. from a school building).

However, as many have pointed out, taken literally the “golden rule” ignores the role of a national currency. With a national currency, as is the UK case, a government can borrow from itself via the central bank for any expenditure. Servicing this debt is costless, involving a simple transfer of revenue from one public body (the central government) to another (the central bank).

Analytically sound is the explicitly flexible budget guideline of shadow chancellor John McDonnell, borrow to invest and balance current spending with revenue over the economic cycle. Osborne’s extreme version FBG has proved so ideologically successful, rather like a virus of the mind, that it compels all politicians to commit to some balancing rule. The shadow chancellor deserves credit for finding the most flexible and least ideological variation. As explained below, in effect the McDonnell budget guideline commits the Treasury to balancing expenditure and revenue as a possible outcome of countercyclical output stabilization, not as a goal.

Fiscal Balancing in Practice

A basic problem with the FBG in all its versions is the inherent improbability of achieving it. The improbability emerges clearly when we inspect the conditions for its successful implementation. A basic specification of the relationship among aggregate economic variables demonstrates the balancing problem.

When an economy is at less than full potential, private and public demand determine the level of national income. To keep the discussion simple, I leave out foreign trade, treat private investment as constant, all public revenue is strictly proportional to national income (for example, at 35%), and current household disposable income determines current household consumption. All changes in this example result from adjustments in public expenditure.

Assume that the budget balance is negative and we have an Osbornite as chancellor, committed to reduce the deficit quickly. He or she can increase taxes or reduce expenditure. The Osbornite goes for expenditure cuts. The expenditure cuts reduce aggregate demand, causing a fall in national income and disposable income that result in a decline in tax revenue. As a result, public borrowing declines by less than the cuts themselves. To employ a canine metaphor, the expenditure cuts have the deficit chasing its tail.

In this simple case to maintain orderly fiscal management and meet his specified targets the chancellor must have an accurate estimate of an interactive system in which the indirect or second round effect of a cut in expenditure is a fall in revenue. To assess this interaction the chancellor and advisers need to know the values of two key behavioural relationships – the marginal tax-to-GDP ratio and the marginal consumption-to-income ratio for households (“marginal propensity to consume”).

As George Osborne’s repeatedly missed targets show, in the concrete conditions of the real world, feedbacks prove extremely difficult to estimate. The complications include the openness of the UK economy to foreign trade, variations in time of adjustment for revenue collection and private investment decisions, and the changes in employment and wages that result from the fiscal cuts.

Estimates can and will be made – that is the purpose of the statistics profession – but they come with a substantial marginal of error (“random variation”). When, to the feedback interactions, we add Osborne’s changes in tax rates and regulations, forecasts become uncertain to the point of unpredictable. The Chancellor has verified this unpredictability, finding it necessary to conjure external causes for the fiscal instability generated by his policies. Simultaneously the instability has created a heavy fiscal drag depressing output expansion. As a result the current recovery is halting and slowest on record.

Fiscal Balance over the Economic Cycle

Far more complicated still is to balance expenditure and revenue in an economy with changing levels of output. Osborne’s version of deficit aversion dogma sets the target of a budget surplus in “normal times”. Rather than attempt to find meaning in this vague term invented off-the-cuff by the Chancellor, I focus on the commonly used “over the cycle”, in practice a period of about four to seven years.

Calculating the interactions and feedbacks among economic variables when basic parameters are certain to change is the most obvious problem with a multi-year fiscal commitment. Even prior to that, intractability begins with defining and measuring “the economic cycle”. If we use a consistent definition this is easily done after the fact. An over-the-cycle target of any type requires an ex ante estimate of the future course of the economy. The experience of the last six years shows that only a fool or a knave follows Osborne’s lead and specifies a time period over which the public budget balances. Neither the beginning nor the end of a cycle is predictable even in principle.

If the promise to “balance the books” is retrospective, then achieving it depends on definition and measurement. One cycle ends when the next begins, and that tautology takes us nowhere analytically or empirically. Definition and measurement of cycles should not be tasks assigned either to the Treasury or the Office of Budget Responsibility. The former has a conflict of interest (never wants to be wrong) and the latter’s objectivity is dubious.

More fundamental than definition and measurement is what a chancellor thinks causes “the economic cycle”. Osborne and the Cameron government view the cycle as a natural phenomenon that occurs independently of the actions of policy-makers. It cannot be avoided. Like the weather the government can only prepare for its impact (“repair the roof while the sun shines”, as Osborne is fond of saying).

In contrast shadow chancellor John McDonnell views the economic cycle for what it is, the manifestation of the inherent instability of a market economy. Pragmatic and non-ideological use of fiscal policy provides a powerful method to reduce that instability. Though “boom-and-bust” cannot be eliminated, with active fiscal management the duration and amplitude of cycles are subject to policy influence.

Managing the economic cycle to minimize instability is simultaneously management of revenue and expenditure. Expenditure policies are a major determinant of revenue flows. For George Osborne this fact of fiscal life is a curse, leading him into repeated policy failures. For an enlightened chancellor the expenditure-revenue interaction is a blessing because of the automatic stabilizing effect of revenue flows. The balance between revenue and expenditure – “making ends meet” – becomes an outcome derivative from the primary task of a chancellor who knows his job, minimizing market instability at the aggregate level.

Constraint on Fiscal Management

This rational approach to fiscal management – in contrast to the illusion of deficit management – can under unusual circumstances encounter a public debt constraint. Since the end of WWII this constraint has not been operative for UK policy makers. Understanding the nature of this constraint and why it is unlikely requires overcoming an ideological phobia as powerful as Osborne’s deficit obsession. Osborne seems to labour under the myth that some absolute or relative level or public indebtedness represents the borderline between sustainability and disaster.

The most infamous version of the debt-sustainability fallacy is the Maastricht rule that gross public debt should not exceed 60% of GDP. This rule starts with a technical error, measuring public debt as gross liabilities rather than net. The UK Treasury and almost very national government employ the net measure (gross debt less liquid assets such as central bank holdings of foreign currencies). Why the Treaty uses a technically flawed measure has been a source of considerable speculation.

If 60% referred to the net debt it would be only slightly less absurd. As anyone with a mortgage knows, servicing cost determines the sustainability of a debt. For a household the borrowing rate and repayment period determine servicing cost. The International Monetary Fund has a standard formula for calculating the sustainable net debt to GDP ratio for governments similar in principle to the household mortgage (though it implicitly treats the case of debt held overwhelmingly in a foreign currency which is not the case for the UK debt).

Three key numbers to calculate UK debt sustainability with IMF formula are the public sector fiscal balance without interest payments (primary balance), interest rate for public borrowing and the sustainable growth rate of the economy (find those numbers here). The calculation yields a debt-to-GDP ratio almost double the current 83%. Despite what the Chancellor might allege, UK fiscal policy is not constrained by the public debt, nor likely to be in the foreseeable future.

Should the opportunity arise, a pragmatic chancellor should not pay down the debt; instead the government should use the revenue to build up the economy (part of McDonnell’s fiscal guidelines). This approach implies an active fiscal policy in which public investment provides a strong driver for growth and current expenditure rises and falls to maintain the economy close to the growth potential that investment, public and private, creates.

John Weeks is Convenor of EREP, Economists for Rational Economic Policies.

Technical annex

Budget balancing in the short run

Algebra facilitates understanding of the interaction of public expenditure and revenue. I assume the simplest case in which the key parameters are known and do not change. There is no external trade or capital flows, and no random effects to complicate outcomes.

National income (GDP) = Y

Aggregate demand = C + I + G

Short run stability requires Y = C + I + G

I = private investment

G = government expenditure

Household disposable income = (Y-T)

Public revenue = T = bY

C = household consumption = a(Y-T)

Y = a(1 – b)Y + I + G

Y = (I + G)/[1 – a(1 –b)],

and define,

[1 – a(1 –b)] = 1/m (the “multiplier”)

The fiscal balance is B = (T – G).

B = T – G

B = aY – G

From above,

B = am(I + G) – G

B = amI + (am – 1)G

Assume the fiscal balance is negative. The chancellor seeks to eliminate the deficit by cutting expenditure in the same amount as the deficit, –ΔG = B. Assuming no change in private investment,

ΔB/ΔG = am – 1 (note that a decline in the deficit is a positive number)

ΔB = ΔG if and only if the multiplier is zero.

A zero multiplier occurs if Y is at its maximum (full potential). Studies suggest that in recessions the UK public expenditure multiplier lies between unity and 1.5. Using the mid-point of that estimate and the UK marginal tax rate of .35, a one pound reduction in public expenditure reduces the deficit by about 55 pence. The one pound expenditure cut simultaneously contracts GDP by £1.25. Thus, the expenditure cut achieves a 55 pence reduction in the deficit through depressing national income by more than double that amount.

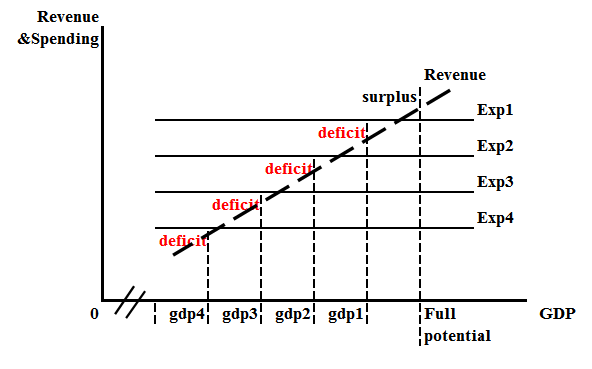

Figure 1 shows the expenditure-deficit interaction, with the sequence beginning at expenditure level Exp1 which by assumption is associated with output gdp1 and a fiscal deficit (vertical distance between Exp1 and the revenue line at gdp1). A cut in spending by an amount equal to the deficit (line Exp2) brings a new output level gdp2 where the deficit is slightly lower. Successive expenditure cuts bring smaller and smaller deficits, at the cost of lower and lower output.

The principle demonstrated in Figure 1 applies to an economy that manages to expand despite fiscal cuts, perhaps through a stimulus from exports; i.e., that budget cuts generate output contraction and/or slower growth. The algebra and the diagram presume that all parameters are stable and known.

In Figure 1 the economy would generate a budget surplus were it at full capacity, but the initially stable level of national income is lower, at gdp1. Following the terminology of the Treasury and the European Commission, this is a “structural surplus” (the fiscal balance at full capacity, eliminating cyclical effects).

Given the level of private investment and all parameters, the surplus prevents the economy from achieving full capacity. As output expands beyond gdp1, the extraction of revenue reduces the effective demand of households without a compensating increase in demand elsewhere.

When the economy is below full capacity a “structural surplus” is a drag on an economy. Therefore, a balanced budget at less than capacity constrains expansion. To state principle simply, contrary to the Treasury, EU and OECD, a structural surplus should be avoided.

Figure 1: Mr Osborne’s Dilemma:

Budget cuts & the fiscal balance

Budget balancing over the cycle

The analytics of short term fiscal adjustment, essentially an exercise in comparative statics, are considerably simpler than changes over time. To make cyclical effects tractable I begin with the simplest case: the cycles are predictable and strictly repetitive with no non-cyclical expansion or contraction. GDP cycles around its average, indicated in Figure 2 as zero.

Under these assumptions there exists a unique tax rate that would achieve a balance of revenue and expenditure from one peak to the next, shown by the two vertical dashed lines. By assumption when above its average GDP generates a surplus, then a deficit when below the average (fiscal balance shown in blue). This might be taken as a rigorous statement of the “balancing over the cycle”.

The cycles exactly repeat each other and the peak-to-peak fiscal balance is zero. If the cycle is not symmetric the peaks occur at different levels of GDP, and/or the downturn and the recovery are of different lengths. For asymmetric cycles the assumption of predictability becomes untenable. As a result, an ex ante commitment to equating revenue and spending over a specific time period is little more than a shot in the dark.

Figure 2: Fiscal balancing over the cycle

(symmetrical & no growth)

One Response

Excellent summary of the arguments. Explains them perfectly.

A minor quibble – if you use symbols in an equation, please define your symbol + units. I know you were keeping it simple, but it ensures that we can follow your mathematical argument without having to guess what the symbols mean.