Complements or substitutes?

Over the summer in OurEconomy my PEF colleague Guy Standing argued that proposals for Universal Public Services (UBS) are not substitutes for the Universal Basic Income (UBI) that he has advocated so cogently. I strongly agree. The two are overwhelmingly complementary. As we approach a UK general election on 12 December and the parties prepare their manifestos, revisiting the UBS and UBI becomes quite relevant.

Review of two public policy frameworks, progressive liberalism and social democracy, helps to clarify the complementarity. To be clear on terms, I use “progressive liberalism” to refer to the political ideology of fostering greater equality and human welfare through market intervention. By social democracy I mean the political ideology that seeks greater equality and human welfare by limiting the role of markets.

I use “social democracy” rather than “socialism” to make democratic participation explicit. Social provision rather than commercialization is the underlying political economy of social democracy. Social democrats restrict markets; progressive liberals regulate and intervene through them. Both share the principle of “universal provision funded by progressive taxation”.

The progressive liberal approach places emphasis on the wisdom of the individual. For example, a public programme should if possible provide people with the means to purchase and choose among forms of transport rather than directly subsidising all or some forms of transport. Social democracy recognises the rights of individuals, treating those rights in the context that people are members of society. The markets that provide choice to individuals are also vehicles to generate inequality, pollution and consumerism.

The two positions would appear to reduce to “let people decide” versus “public sector paternalism”. Apparently incompatible ideologically as suggested in an article by Polly Toynbee after the election of July 2017, they are in practice complementary.

Public provision and individual choice

To proceed I need to treat several issues that could divert the discussion into unproductive cul de sacs – what we should compare, affordability and definition of terms. A responsible approach to UBI and UBS requires that I treat both in their most complete and favourable forms. Juxtaposing a crude version of one with the best manifestation of the other serves a polemical purpose not rational discussion.

Second, as I argue in my new book, The Debt Delusion, concerns over the affordability of UBS and UBI frequently confuse cost of a programme with allocation between public and private provision. As everyone with few exceptions recognises, people conduct their lives within the constraints of the society in which they live. Our society sustains itself through the collective generation of its reproduction. The collective process of social reproduction requires transportation to carry out our daily tasks, communicating with others, maintaining the health of our citizens, educating the population, housing families, and feeding ourselves.

While each of these activities appears as an individual choice, they are part of a social process in which each is sustained, “paid for”, by a combination of public and private expenditure. Shifting from private payment to public payment does not involve a cost. It is an allocative choice made through democratic procedures. All the basic needs in society are “universal” in the sense that everyone through public support or private expenditures must provide for transport, health, education, housing and food.

How these basic needs should be funded is a social policy decision not an affordability issue. For example, creating a comprehensive public health service reflects a collective decision that the burden of funding good health for the population should fall on society as a whole, not individuals. Public provision of health services involves the ethical judgement that all citizens should enjoy protection against ill-health, and the practical consideration that an informed individual choice is not possible among health care alternatives.

In contrast, informed choice in purchase of food and clothing is possible, which implies that private purchases provide an appropriate source for providing these basic needs. Public sector cash transfers through basic income can mitigate the distributional inequality that constrains market access.

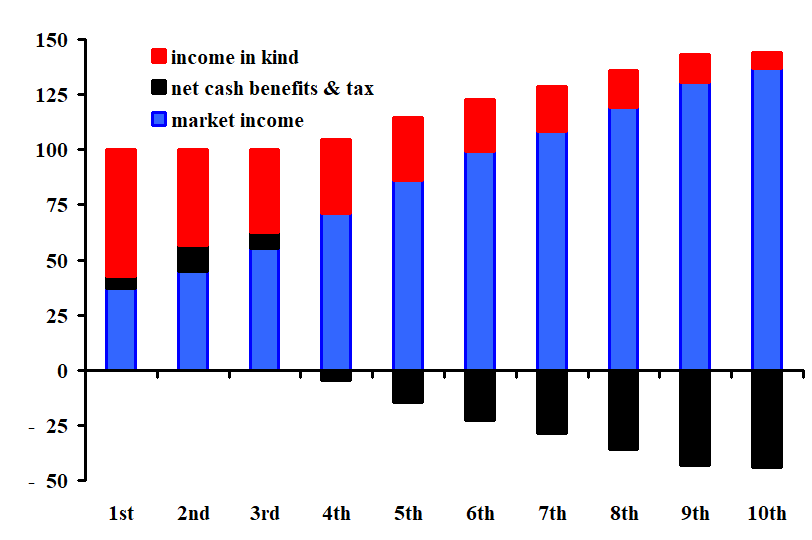

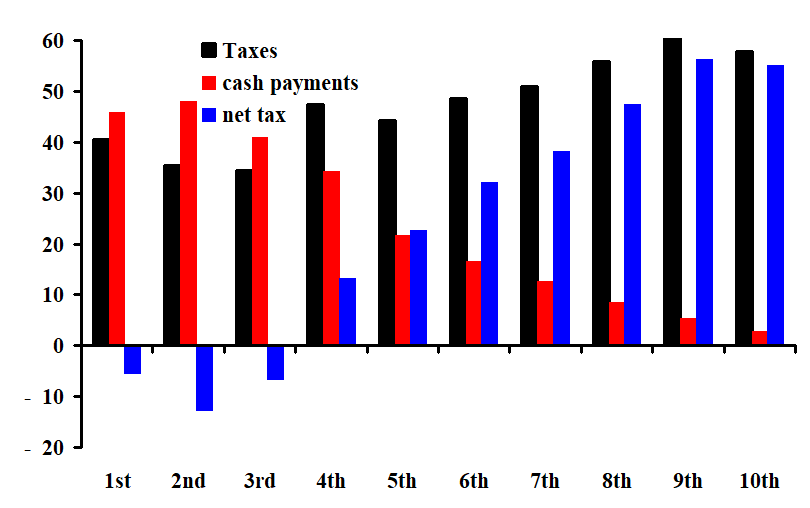

The first chart below shows the relative importance of the three categories of household income in actual income flows for tax year 2017/18 across the income distribution by deciles of the population. The three functional categories are market income, public sector cash transfers less tax payments, and income in kind from public provision (see notes to first chart for details). The second chart shows cash transfers and tax separately. For the average household, market income (“original income” is the ONS category) accounted for just over 100% of final income (£37,200), income in kind 22% (£9300) and cash benefits less tax minus 25% (minus £9500). For households at average incomes, tax payments exceeded public sector transfers in cash and kind.

The distribution of the three categories across deciles should come as no surprise. Net cash benefits are positive for the lowest three deciles of the distribution, become slightly negative in the fourth quintile, then increasingly negative as the average tax per decile rises. Net cash benefits hit their peak at 12% of final income in the second decile. The poorest tenth of the population does not receive the largest share of net cash benefits because the greater relative importance of indirect taxes for the poorest and their lower state pension.

The largest inequality reducing effects come from transfers in kind, health services and public education.Both are universal without charge at point of delivery.Health services represent about £5300 for the average household, peaking in the fourth decile (£6200) then declining to its lowest level for the richest 10% (£4600). All the public services are strongly equality-enhancing after the first decile. Surveys show that the higher is family income, the lower is the take-up of public services.

UK Household Income as Share of Final Income by Deciles, 2017/18

Notes: Market income includes income from employment and rentier income (interest and investments), private pensions and work benefits in kind. Net cash benefits & tax include more than 21 programmes of which tax credits and state pension are the most important; direct and indirect taxes subtracted. Benefits in kind come from seven programmes with education and health the largest. Source: ONS

UK Household Taxes & Cash Payments as Share of Final Income by Deciles, 2017/18

Notes & source: See first chart.