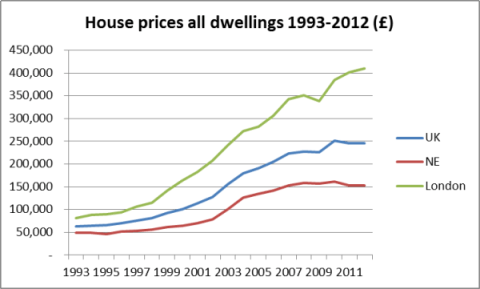

From 1993 to around 1998, the gap widened but slowly between London and other parts of the country. But since the Coalition Government came to office, London has shot ahead of other regions. In June 2010 (also from ONS figures) the house price index for the UK (with 2002 = 100) stood at 177, and is today at 182. The London index was 171 in June 2010, and is now 198. London prices are rising at a rate of over 5% per annum at present.The UK index excluding London was 177 in June 2010 – and is today at…177!

A similar picture faces first-time buyers. Here is the 20 year chart for the average house prices for first time buyers, 1993 to 2012.

UK house prices 1993-2012

A first-time buyer in London is paying over £300,000 for his or her home; with a 75% mortgage, they must have over £75,000 deposit. Tough going to save up for this when the average salary is around £27,000 per year.

So this is where Chancellor George Osborne stepped in with his Help to Buy scheme, under part 2 of which from January 2014, the taxpayer will provide guarantees to lenders – i.e. banks and building societies, providing that the “purchaser” can put down 5% as a deposit on a property of up to £600,000. In the government website’s prose:

“Help to Buy mortgage guarantees will be open to both first-time buyers and home movers. However, you won’t be able to get a Help to Buy mortgage guarantee if you’re planning on renting out the property. The guarantee is provided to your lender – not to you.

To qualify for a Help to Buy mortgage guarantee, the home you want to buy must be offered for sale at £600,000 or less. The property can be newly built or already existing. You don’t have to be a first-time buyer and there’s no limit on your level of income.”

In other words, you need to put down just £30,000 to buy a house for £600,000, with the rest of us guaranteeing your lender that you will honour the deal!

As the witches in Macbeth put it,

“For a charm of powerful trouble, Like a hell-broth boil and bubble.

Double, double toil and trouble; Fire burn and cauldron bubble”..

And when Hecate enters she congratulates them:

“O well done! I commend your pains; And every one shall share i’ the gains..”

But alas and alack, it all ends in tears.

5 Responses

It’s the land. Tax the land and house prices will fall to the (mostly second-hand) building price. See ‘How a land value tax would help resolve Britain’s housing crisis’ and ‘Land Value … for Public Benefit’ http://www.labourland.org/lvt/papers.php.

Very few people are aware, or remember that after Thatcher persuaded tens of thousands of people to buy their Council houses in the 1980’s, they swapped being a tenant paying rent to the Council, for essentially being a tenant of a bank or building society, and paying rent to them in the form of monthly mortgage payments. In 1990, when interest rates rose, many found they could not make the payments and lost the home many of them had lived in for many years.

In the 18th Brumaire of Louis Bonaparte, Marx describes an almost identical situation in France of the time. After the Great Revolution, peasants were encouraged to borrow money to invest in the land that had been distributed from the great estates. They did so at low rates, and at a time when agricultural prices were quite high. The investment in additional production raised output and lowered agricultural prices. When interest rates then rose, the peasants were pauperised.

A similar thing could be seen with the Emacipation of the Serfs in Russia in the 1860’s. They had to pay huge sums to their former masters.

People cannot pay their debts out of selling their houses, essentially because they have to have somewhere to live! That is the lunacy of Britain’s infatuation with rising house prices. If I buy a house for £100,000, while I really had my eye on a £200,000 house I couldn’t afford, I do not at all benefit from a rise in house prices. My house might double to £200,000, but the house I aspired to has now moved up to £400,000. Where before I only needed to bridge a £100,000 gap, now I have to bridge a £200,000 gap!

There will in fact be a lot of people who bought in the 1960’s, who would still have equity in their house if prices fall by the 80% I expect will ultimately be the case. My sister bought here house in 1972 for £2,000, and today its valued at about £120,000. If it fell to £24,000, even allowing for inflation, it would still be worth more than in 1972! The people who will get really hit are the people who have bought at massively inflated prices over the last 10-20 years, and particularly the buy to letters, who have mortgaged to do so.

Neil…thanks for this comment.That is my fear…the public authorities (by which I mean the OECD, the OBR, the Treasury and even to an extent the BoE) are all complacent about the impact of higher rates on borrowers. The “theory” is that Brits are “asset- rich”…and therefore can sell their assets to pay off debts…but very few pay off their debts by selling the roof over their heads! Most pay off debt from income – and incomes are falling. If falling incomes are hit by higher rates of interest (and the signs of rising rates are there, and quite alarming) then that double whammy will bring down the whole ‘house of cards’ – once again!

House Prices and Interest Rates

The comment was from me, and I’m glad you agree. But, I’d go further. I believe, as I said that the house price indices are fraudulent. They depict asking prices not selling prices. They do not even reflect the fact that even before they are sold, house asking prices are frequently reduced several times. They only reflect the initial asking price. Rarely are selling price quoted by the media. The exception was year when the BBC on their website had an article here where they noted,

“The gap, depending on which measure of selling prices you use, has suggested that homes put up for sale by their deluded owners or estate agents have been as much as 40% over-priced.”

That was based on comparing the average asking price quoted by estate agent surveys, and the average price of a home cited by the Land Registry.

There are good reasons for this ‘conspiracy’, not only in Britain, but across Europe. Deutsche Bank is estimated as having exposure to derivatives equal to the entire global GDP, and the purpose of these derivatives is to hide its exposure to European property debt. Even where property prices have fallen significantly, for example, in Spain, they are still on banks books at inflated prices. Britain is the second most exposed country in relation to its exposure to this European personal debt after France. According to the BIS, total exposure of European Banks to these derivatives is several times global GDP.

If we continue the Alice in Wongaland analogy, we can put mark Carney in the role of the Queen of Rate Tarts. But, the reality is that however much he claims that “The Rate of Interest is whatever I say it is,”, and however, much the media purvey this myth about official interest rates, the fact is that even as Carney has been speaking market interest rates have been going up. As Northern Rock found out, it is market rates of interest, not Bank of England base rate that in the end counts.

Here is my basic thesis. According to Marx and 19th century economists like Bank of England Governor Gilbart, the rate of interest is the result of the supply and demand of money-capital, not money. The difference is this. Capital arises as a result of production. The supply of money-capital is the money equivalent of the surplus product not unproductively consumed. In other words, it is the money equivalent of actual commodities present in the market available as means of production and consumption to expand productive-capital. Consequently, if this money-capital is used for accumulation, it is not inflationary.

By contrast, if money is simply printed and thrown into circulation, it bears no relation to commodities already in the market. The result is that the value of this money is devalued, causing inflation. No real change in the balance of demand and supply for capital has been affected, because the devaluation of money means that the money price of the commodities that make up the productive capital has simply been increased.

Over the last 30 years, we have had a massive rise in productivity that caused the global rate of profit to rise sharply, and also caused the value of commodities to be slashed. Money printing prevented the deflation of commodity prices, but caused a massive inflation of asset prices. Interest rates went through a secular decline because the supply of money-capital exceeded the demand for money-capital, also resulting in massive money hoards in the form of sovereign wealth funds, and large cash balances on the balance sheets of global corporations.

That process has now reversed. Reports show earnings are missing expectations, and although not falling, are no longer rising as quickly as they were. Productivity is slowing, and product innovation by firms like Apple is likewise slowing down. More capital has to be invested to obtain the same rate of growth. At the same time as recent reports in the FT demonstrate, even economies like Germany need to spend lots of capital on infrastructure. A greater quantity of capital invested with slowing increases in the volume of profits means a falling rate of profit. The supply of money-capital falls relative to its demand, and interest rates rise.

Whatever central bankers do, interest rates are going to rise. The bond bubble will sooner or later burst. With it the property bubble will burst, and then the banks will be exposed as insolvent. That is why Osborne, and global central bankers are desperate to stop property prices falling, or that where falling property prices are a reality, it being publicised.

Boffy you deserve a medal. The propensity for individuals to accept high levels of personal debt without a seconds thought astounds me on a daily basis. This financial suicide is allowed by CBs and regulators alike, possibly because they feel they have no other choice. When mortgage rates increase in the UK many are going to have a very nasty surprise.