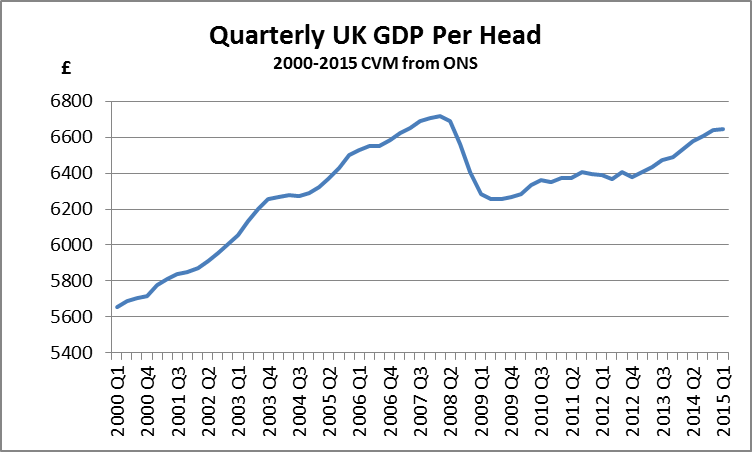

The following chart shows how limited the revival in GDP per head (year on year) has been since 2009. It also shows (blue line covering Conservative or Con/Lib governments, red line Labour) that there have been four periods since 1956 when real GDP per head has fallen year on year – and three out of four were under Conservative governments. (The fourth, in 2009, was of course a bigger percentage fall).