“Those who spent the whole of the past year telling us to follow the American example, with yet more fiscal stimulus, need to answer this simple question: why has the US economy grown more slowly than the UK economy so far this year?”

That was the gauntlet thrown down by Chancellor George Osborne in the House of Commons debate on the economy on 11th August 2011.

Even at the time he spoke, It was a ‘brave’ claim which required an amnesiac approach to the appalling UK fourth quarter of 2010, which showed a 0.5% decline from the previous quarter, compared to the US’s +0.5% increase over Q3. Therefore, this gave a highly misleading gloss to the UK figures for the first quarter of 2011. And in the light of later revisions of the figures, Mr Osborne’s claim was not accurate even as he spoke.

We now have the final GDP figures in for 2011, subject to any late adjustments. Which horse won the race, the UK or the US? Both, it must be said, were pretty sluggish performers. But in the end, the US horse was the clear winner. Here are the respective percentage growth (or decline) figures:

2010 % change

2011 Q on QQ1

Q2 (Q on Q)

Q3 (Q on Q)

Q4 (Q on Q)

2011 % change

UK

2.1

0.4

0.0

0.6

-0.2

0.8

USA

3.0

0.1

0.325

0.6

0.7

1.7

However, the Chancellor’s claim was not just that the UK economy was growing faster than the US’s in 2011, but that fiscal stimulus does not work. That is to say, that his austerity programme was more likely to lead to economic growth.

The US fiscal stimulus has been estimated at $800 billion spread over 2009 and 2010 – large (around 4.8% of GDP) but not of the scale many economists believed necessary. We may also recall that the UK Labour government had itself introduced a (more modest) fiscal stimulus in 2008-09, around 1.5% GDP, which had some effect in increasing economic activity, but which ceased and was replaced with the coalition government’s austerity policy – and an early sign of big trouble came with that Q4 2010 figure of -0.5%.

Taking the last 5 quarters together, we can see that US GDP has grown by around 2.2%, whilst UK GDP has increased by 0.3%, an average of (drumroll!) ….0.06% per quarter. Since the UK population is increasing (0.8% between 2009 and 2010, according to the Office for National Statistics), this represents a significant decline in GDP per head of population. Thus, at the peak the (inflation-adjusted) GDP per head was £6009 in Q4 of 2007; the latest figure is for Q3 2011 when the average was £5686 – a drop of 5.4%. The US annual population growth is also around 0.8%, which means that they have seen a real (if modest) increase in GDP per head of population over the period.

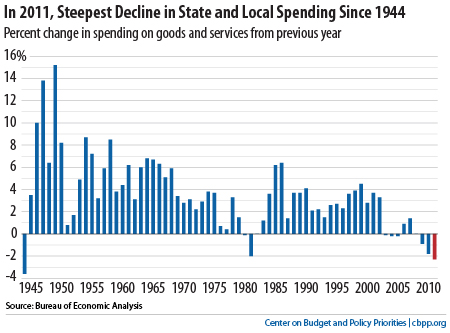

The American economy has at the same time seen a significant de facto austerity programme for sub-national governments (the states and local governments), as the following chart, from the Centre on Budget and Policy Priorities, shows:

article 9 feb graph3

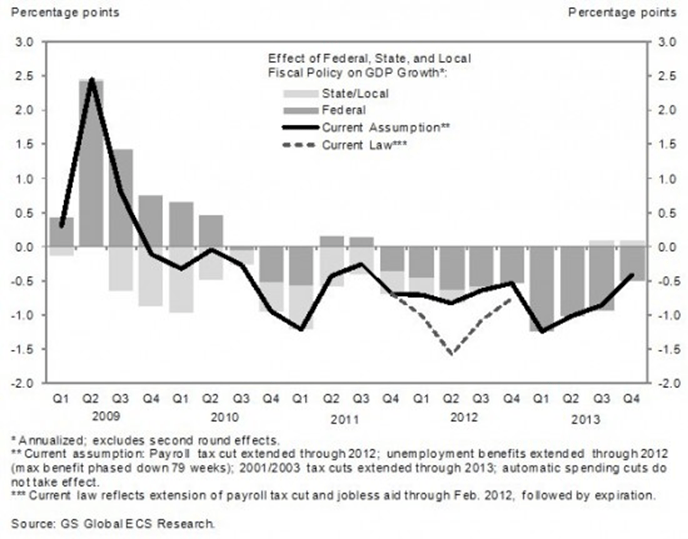

And a further economic ‘drag’ will occur due to further declines in the US federal government contribution to GDP, as shown in the next chart, from Goldman Sachs.

article 9 feb graph2