I recently participated in a BBC broadcast, a ‘Dinner Party Conversation’ on the question of whether globalisation is dead? The conversation was led by the BBC’s experienced presenter Nick Robinson. The other guests included Ted Malloch, Professor at Henley Business School and rumoured to be Donald Trump’s pick as ambassador to the EU. (Mr Malloch is also a controversial figure for reasons other than political, as the FT in particular have indicated). Baroness Patience Wheatcroft, a Conservative who was once editor-in-chief of the Wall St Journal, Europe also participated as did Ed Balls, ex Labour MP and cabinet minister. The show was to be broadcast on Radio 4’s ‘Westminster Hour’, on 9th April, at 10 pm and later issued as a podcast.

The programme is part of an admirable new initiative to devote more time on radio to issues of importance to Britain. The conversation exposed sharp differences between myself and Ed Balls, who was once an adviser to the Labour Chancellor Gordon Brown.

Globalisation and poor countries

Ed Balls, citing his personal experience of Indonesia, argued that globalisation had led to a reduction in poverty in that country, and worldwide. My experience of Indonesia was marked by the grave Asian financial and banking crisis of 1997-8, during which the Indonesian economy went into meltdown, banks failed, very high interest rates prevailed, and the rupiah sharply depreciated. Sustained pain was inflicted on Indonesians that were innocent of the crisis.

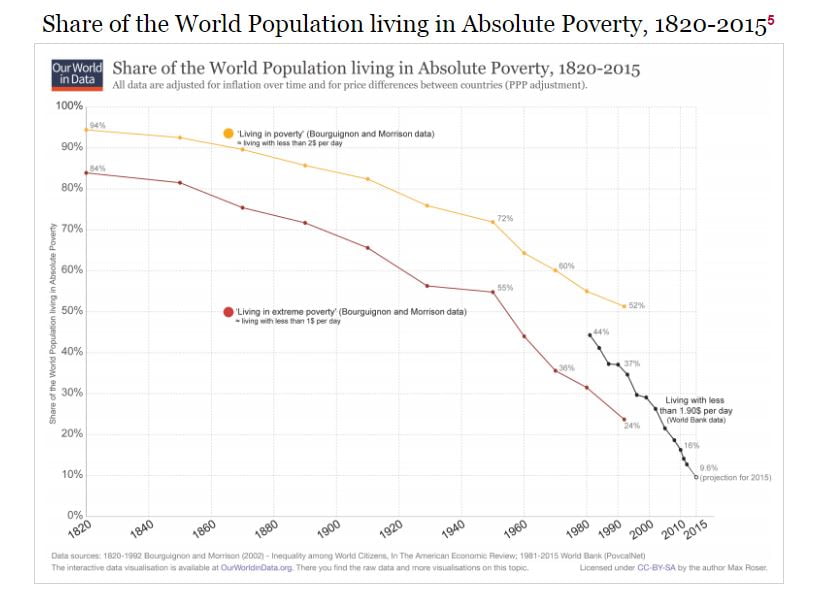

Moreover, while it is true that poverty has fallen worldwide, the phenomenon cannot be wholly attributed to financial liberalisation or globalisation, but instead to advances in e.g. medical science and scientific development. Indeed, the numbers of those living on less than $1 a day fell most rapidly, not during the period of financial globalisation, but between 1950 and 1970 according to Bourgignon and Morrison (see Our World in Data, on global extreme poverty).

(This chart thus shows that the rate of fall in the share of those living on less than $1 a day in 1950-70 is broadly similar to the rate fall in the share of those living on less than $1.90 a day in recent decades, from World Bank data).

To take another example, under communism, life expectancy rose broadly as much as it did under the capitalism of the pre-globalisation era. Despite China’s disastrous Great Famine, life expectancy rose from 44 years in 1950 to 65 by 1970 – well before Deng Xiaoping took power in 1978. In Russia life expectancy increased steadily until after the end of Khrushchev’s administration. It stagnated through the Brezhnev era, and then collapsed in 1991 as a direct result of financial ‘liberalisation’ and ‘shock therapy’.

Globalisation’s failure to deliver & the rise of authoritarianism

In the BBC’s brief and pressured half-hour I wanted to get across that globalisation had not delivered on its promise – to make ‘the market’ the main driver of a more effective, more productive economy; to transform societies into nations of ‘shareholders’; to ensure a revolution in homeownership, and to avoid what Hayek called the threat of a totalitarian state.

Instead financial globalisation has been an era largely fuelled by carbon (oil and coal) – as had been the case for over a century. However, unlike the Bretton Woods era, post 1970s de-regulated financial globalisation was built on mountains of private and public debt. The first – private debt – led to recurring financial crises, and the second – public debt – rose as private sector activity weakened, and tax revenues fell. The consequences of these recurring financial crises in ‘advanced’ economies included ‘austerity’, the removal of employment protection, rising housing and education costs, the return of deflationary pressures, high unemployment, falling real wages, low productivity and rising inequality.

These crises have led to increased insecurity and over-rapid social and economic change- as

well as the greatest financial and economic crisis since 1929 (itself a product of excessive

laissez-faire ideology). More widely, the insecurities and dislocations generated by financial

globalisation have led whole populations to seek the ‘protection’ of a strong man (e.g.

Presidents Trump, Duterte in the Philippines, Modi in India, Erdogan in Turkey,

Putin in Russia). Not that this worries the extreme adherents of laissez-faire – recall how

Hayek supported the murderous dictator Pinochet in Chile for his brutal imposition of

deregulatory ‘reform’.

And so, contrary to Hayek’s expectations, financial globalisation has proved that it is market fundamentalism, and not the regulatory state that is leading the world into an era of authoritarianism and totalitarianism – in the US, Eastern Europe, India and China.

In the UK, average real wages are today lower than in 2008, no higher than they were in 2005, and in general we have to look back to Victorian times for such a stark period of stagnation. In the US, the position has been even more severe for huge numbers of working people. Median annual earnings in the Bretton Woods period rose steadily until just after 1970. Then throughout the age of ‘globalisation’ or financial deregulation, American male real wages have stagnated.

This, I contend, explains the rise of Donald Trump. It is an explanation, not a defence of his authoritarianism or of his administration’s irrational protectionism.

Keynes and capital control

I argued in the programme that capital control was necessary to restore public authority over financial globalisation or mobile ‘offshore capital’. This can be done by bringing capital back onshore and subordinating it to regulatory democracy. While an international co-ordinated approach to do so is best, China for example is already managing capital flows across her borders. Baroness Wheatcroft responded to this point by saying that she did not want to live under a “socialist” system. But such a system would not be socialist. Instead it would represent a return to the Keynesianism of the Bretton Woods era. Ed Balls muttered something that I understood as “Keynes would be turning in his grave” at a call for capital control.

He is wrong, for Keynes was a firm advocate of capital control. In 1941 he wrote:

“Nothing is more certain that the movement of capital funds must be regulated ; – which in itself will involve far-reaching departures from laissez-faire arrangements” (CW XXV, p. 31 , 8 September 1941: memorandum: Keynes’s ‘first shot at post-war currency policy’).

Then later:

“I share the view that central control of capital movements, both inward and outward, should be a permanent feature of the post-war system”. (CW XXV, p. 52 – a more formal version of his plan).

Then the key analysis, in a letter to Roy Harrod dated 19 April 1942:

You overlook the most fundamental long-run theoretical reason. Freedom of capital movements is an essential part of the old laissez-faire system and assumes that it is right and desirable to have an equalisation of interest rates in all parts of the world. It assumes, that is to say, that if the rate of interest which promotes full employment in Great Britain is lower than the appropriate rate in Australia, there is no reason why this should not be allowed to lead to a situation in which the whole of British savings are invested in Australia, subject only to different estimations of risk, until the equilibrium rate in Australia has been brought down to the British rate. In my view the whole management of the domestic economy depends upon being free to have the appropriate rate of interest without reference to the rates prevailing elsewhere in the world. Capital control is a corollary to this. Both for this reason and for the political reasons given above, my own belief is that the Americans will be wise in their own interest to accept this conception, even though its immediate applicability in their case is not so clear. (CW XXV, p. 149, my emphasis)

Financial globalisation compared to an earlier era

The three decades that preceded globalisation were decades in which governments managed flows of capital across borders. The result was summarised by Barry Eichengreen and Peter Lindert (well known historians of the financial sector) as “a golden era of tranquillity in international capital markets, a fulfilment of the benediction ‘May you live in dull times’ … Sovereign defaults and liquidity crises were relatively rare.” (Barry Eichengreen & Peter H. Lindert, 1991.)

Employment rose everywhere. Politicians and economists cared about unemployment, and worked to reduce it. Inequality and income distribution narrowed. Productivity rose. Demand was strong. Public debt fell. There was a downward trend in those living in absolute poverty. The average annual increase in world GDP – the expansion of economic activity – was higher in the period 1952-75 than in the period since 1975, although most of that expansion in economic activity was in the advanced economies.

Conclusion

In conclusion, while globalisation, or financial liberalisation is not dead, it is in decline, and deeply unpopular. Unfortunately, public anger and concern focuses on the tangible outcomes of free, unmanaged flows of capital, trade and labour, and not on the intangible, invisible and unaccountable global finance sector. Advocates of globalisation as well as their opponents continue to draw attention to flows of trade and labour, thereby deflecting attention from that which is most causal of instability and insecurity: financialisation of the global economy.

Until the public understands that it is imperative to manage flows of capital; to bring offshore capital back onshore and thereby restore for example, democratic control over the taxation of global corporations, for so long will the protectionist focus on immigrants and trade deals remain paramount. And for so long will authoritarian leaders who pretend they can manage both, remain powerful.

One Response

In my country, localisation thrives. We have a lot of money. My country is very rich but citizens are very poor. The capital remains in the country, stashed away by greedy politicians. We have onshore capital buried everywhere, capital that would have contributed to human and social development. The citizens suffer illegal transactions between global corporations and democracy leaders, thereby fleecing the citizens. We have 2 problems to deal with at once, globalisation that is an instrument of fleecing the masses, and localisation that does not benefit anyone (as most of the stash are not used).