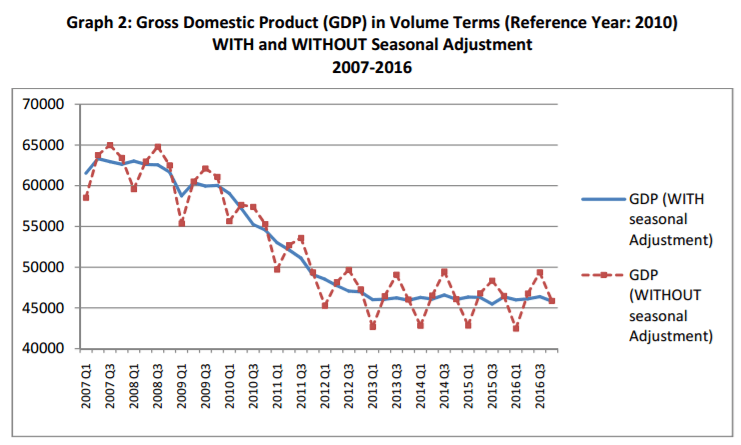

What is more extraordinary is that current price (i.e. nominal) GDP has fallen even further than real GDP over the decade – by 28.5% From 2008 to 2016, GDP fell quarter-on-quarter in no fewer than 27 out of 36 quarters, of which two in 2016.

Looking at the elements of GDP, we see that nominal consumption expenditure in Q4 was almost identical to the year before, with household consumption up a fraction, and government “consumption” down by about the same. The significant fall was in GFCF – capital investment – down 18%. Net trade improved slightly on Q4 2015 as exports increased more than imports – but exports were lower than in Q4 2014, so there has been no big turnaround in trade.

Turning to income, there has been scarcely any movements over the last two years in Q4. The figure for compensation of employees is almost identical to that of 2015 and 2014, meaning that the small increase in employment is offset by lower wages. The gross operating surplus / mixed income figure is similar to Q4 2014, but a little higher than 2015.

The general picture of stagnation at a level far, far away from a positive equilibrium is emphasized when we look at the employment and unemployment statistics, also via Elstat:

Chart via Elstat