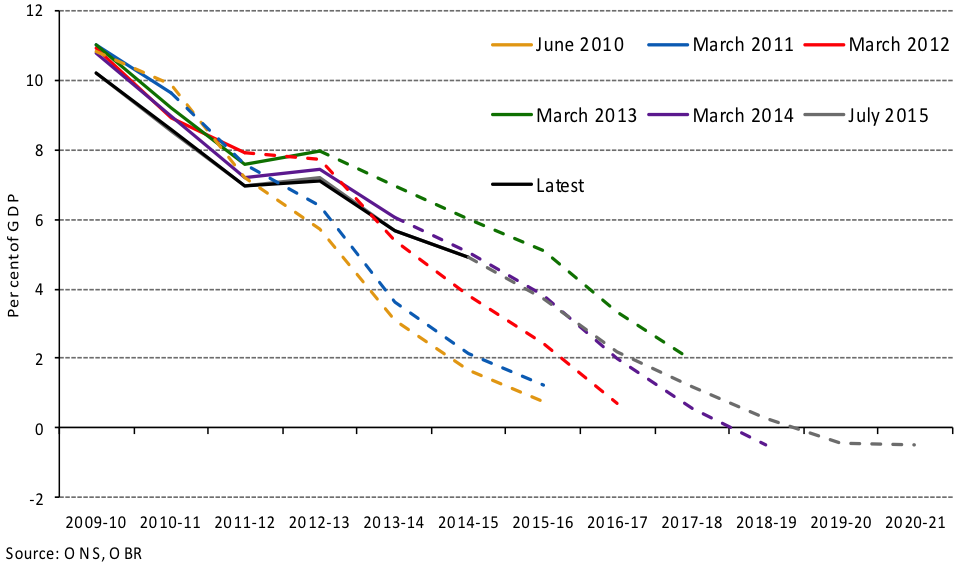

Each year the OBR expectation was that the target for current budget balance five years ahead was achievable [2] . In fact the original five year target, set in 2010, was missed by two percent of GDP and net debt was still rising. Even so, the OBR still expected the latest target, for current budget balance by 2019/20, to be achieved. Our own (pre-referendum) forecast using the CBR macro-economic model was that this target would be missed by 1.5% of GDP.

There are a number of possible reasons why the targets were missed. One was that the degree of austerity was insufficient. In fact a degree of austerity had been inherited from the previous Labour government whose Fiscal Responsibility Act of February 2010 had mandated the Government to reduce the net government borrowing each year as a percentage of GDP reaching 5.5% by 2013-14 [3]. This Labour target was in fact reached by the Coalition. However, immediately after the 2010 election, George Osborne had changed the target. He expressed it in the more nebulous form of a cyclically-adjusted target, now applying only to current revenues and spending. The Labour target had applied to all government borrowing, but was equivalent to 3% of cyclically-adjusted GDP. Osborne’s new target was also moved on one year, and in 2010 was for a balanced current budget on a cyclically-adjusted basis by 2015. This represented a tightening of the target by around 2% of GDP.

The new more ambitious target needed a strengthening of austerity and this did occur for a year or two. The Labour target had been judged to be consistent with annual growth in real government consumption of 0.8% [4] . As a political chancellor, Osborne front-loaded his austerity with virtually no growth in real government consumption in 2010 or 2011 (but no overall reduction either). The reliable Keynesian multiplier impact led to slowing growth in GDP in 2011 and 2012. Consequently, austerity was temporarily reduced, firstly in 2012 and again in 2014 and 2015 in time for the general election. Over the whole Coalition period, 2010-15, growth in real government consumption was 0.9% per annum almost exactly the same as Labour had planned for this period.

This was then a cautious Tory Chancellor, but one who affected to belief that austerity targets, tighter than Labour’s, could be achieved. He was of course encouraged in this belief by the twice-yearly OBR forecasts. As we have argued, the OBR was over-optimistic in 2010 and in our view remained over-optimistic in 2015. OBR forecasts played a role in setting the targets, with over 50 meetings between the OBR and Treasury senior staff in each forecasting round. The OBR’s over-optimism was not accidental, and was almost inevitable due to the nature of its forecasting methods.

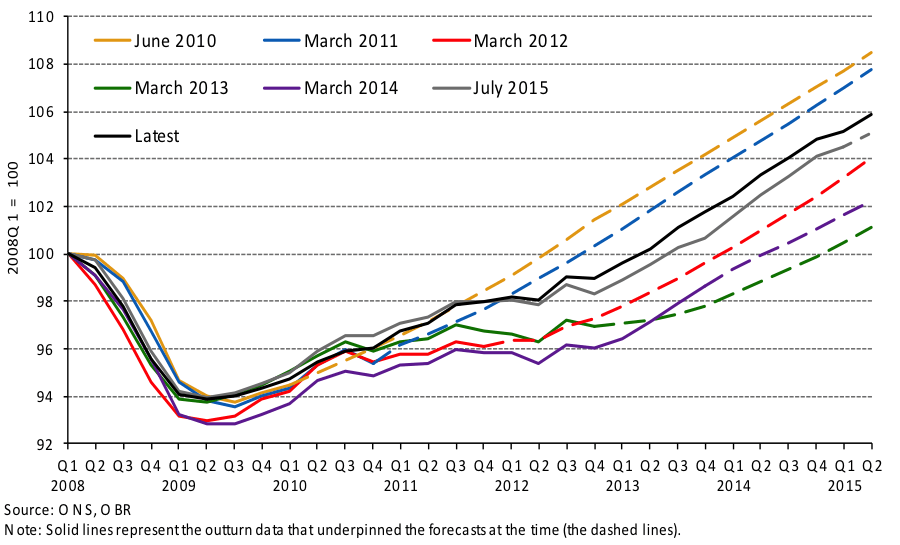

These methods revolve around an arbitrary assumption for the future growth of labour productivity. Together with Office for National Statistics projections for working-age population and hence labour supply (themselves based on arbitrary assumptions on international net migration), the labour productivity assumption determines a track for the growth in productive capacity. Despite the fact that productivity, measured as GDP per person employed, has hardly increased at all since 2007, the OBR persist in expecting it to revert to earlier trend rates of growth in every future year. Until Autumn 2015 the assumption for productivity growth was 2.2% per annum, but in March 2016 this was reduced to 2% per annum after a temporary winter wobble in global stock markets.

At the start of each forecast exercise the OBR takes a view on how far detached the economy is from full-capacity operation, and then assumes convergence of GDP to full-capacity operation over 3 -4 years. Separate forecasts for household consumption, company investment and other components of GDP are massaged to fit the top-down assumed path for aggregate GDP. The component selected to bear the brunt of this balancing process is business investment, usually with at least 4 consecutive years of annual growth in the range 8-10%. In practice, no year of growth as high as 8% was actually recorded. The important point is that these overly optimistic assumptions led the OBR to project an unrealistically rapid growth of tax revenues and hence an unrealistically rapid decline in government borrowing.

A particular feature of the period after 2010 was a rapid growth of employment with an additional two million employed, of which 60% were foreign-born mostly working at close to the minimum wage. By 2015 the employment rate of working-age people had, as a result, reached a historically high level. In consequence the OBR’s measured ‘output gap’ closed to virtually zero in 2015. The forecast for GDP was then wholly determined by the OBR’s assumption for productive capacity. In March 2015 this assumption was 2.2% per annum and hence the OBR forecast for GDP growth was 2.2% in every forecast year. Once again their forecast for budget balance by 2018-19 was wholly dependent on their assumptions for productivity growth, assumptions which have regularly proved much too high.

Chart 2 OBR Forecasts for Real GDP