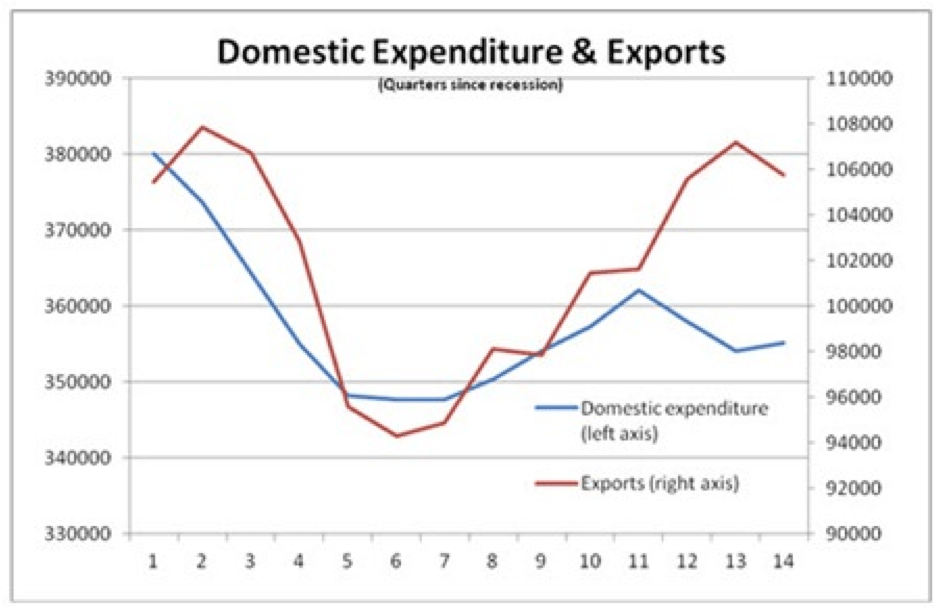

In fact the opposite is the case. The British economy comprises 14.5% of the entire EU economy, in OECD terms approximately $2trn of a total $13.8trn (in Purchasing Power Parities). Yet even before the latest downward revisions to GDP by the Office of National Statistics are included, the OECD data show that the entire loss in EU GDP was $355bn, of which British economic weakness is 21.4% of the total, equivalent to $76bn. As the chart below shows, the British economy has been a brake on the Eurozone economy, not vice versa.

Chart 2

Returning to the ONS release, the total loss of output since the UK recession began is £65.2bn. The total loss of investment (Gross Fixed Capital Formation) over the same period was £43.3bn, that is almost precisely two-thirds of the entire recession. But the latest data also represent a turning point. The total loss in household consumption during the recession was larger at £51bn, over three-quarters of the total contraction in the economy. The fall in household consumption began to outstrip decline in investment in the 1st quarter of this year.

This loss in consumption has therefore not been the catalyst of recession. The decline in investment preceded the recession by 6 months. Declining investment was the driving force of the recession. But it does indicate that there is a new and significant and pressure on household spending in the British recession. Other components of the national accounts have risen over the same period, notably government current consumption and net exports.

It is also no longer the case that the private sector fall in investment exceeds the total decline in investment. Previously, this had been the case as government investment had risen. As a result the fall in private sector investment had amounted to 80% of the total lost output through the course of the recession. Now the decline in private sector investment amounts to £36.5bn – 56% of the total decline in output.

But government investment is now falling. In total, government investment has fallen since the recession began, down £6.8bn. This is a function of government policy. Since the Coalition government took office, government investment has fallen by £12.2bn, more than reversing the very modest rise in investment of the previous Labour government. The direct effect of the government decision to reduce investment is to cut GDP by 0.9%.

These are only the direct effects of declining government investment. It is now commonplace to speak of a continuous recession from the 1st quarter of 2008. However, the actual inheritance of the incoming government in June 2010 was an economic recovery underway, which after the latest revisions is now shown to be stronger and longer than previously estimated. The economic recovery lasted 5 quarters and GDP expanded by 2.8%, whereas previously it was estimated at 4 quarters long and a recovery of 2.5%.

The previous government did not begin to increase investment until the 4th quarter of 2008. For the rest of its term of office, government investment rose by £27.2bn. But this also had an indirect effect, primarily by encouraging private sector investment, so that the economy expanded by £38.7bn in total.

Using the same ratio, the current government’s decision to reduce its own investment will have led to a total decline in output of £17.4bn, or 1.3% of GDP.

Conclusion

The UK economic stagnation is due to domestic governmental policies. It began before there were any negative effects from the Eurozone’s turmoil, and is primarily a function of the government decision to reduce its own investment.

A version of this article was previously posted on Socialist Economic Bulletin >