George Osborne’s Autumn Statement speech to the House of Commons was nothing if not brash and brazen, aiming to give the public and MPs the impression that his decisions to limit – or mainly to defer – some of the more egregious anticipated spending cuts was down to his skill and determination. To show that he had sailed the ship of state through stormy seas safely to harbour, whilst simultaneously repairing the roof while the sun shone.

Wrong! Look more closely, however, and you see that, in reality, he had played the old Three Card Trick, in which the public is allotted the role of ‘the shill’ who falls for the trick. The three cards, in this particular version of the game, are marked ONS, OBR and Bank of England.

The OBR card is the most marked and well-worn. Remember, the OBR last made its estimates in July – that is, a mere 4 months ago. Sure, some things change in 4 months, but the scale of turnaround in their estimates is truly remarkable, absent any very obvious changes in the economic environment. Government receipts are forecast to be higher by over £60 billion over the life of this Parliament – even though October’s public finance report showed a slowdown.

In the new Economic and Fiscal Outlook we read:

The improvement in the underlying forecast since July… is largely due to an improvement in expected revenues. This reflects higher expected receipts from income taxes, corporation tax and VAT.”

As I said, it’s hard to see what has really changed to justify this shift, especially since the positive changes in receipts in the early part of the financial year have slowed over the last quarter.

The OBR card has more on it than this, however. They have also changed the assumption as to future GDP annual increases. So what has changed? Here, we find the second card played – the Office for National Statistics (ONS)

Since our July forecast, the ONS has published the 2015 Blue Book. Methodological and other changes have led to upward revisions to the level of nominal GDP – by 1.1 per cent in the first quarter of 2015. The ONS has also revised real GDP growth down from 1.9 per cent to 1.5 per cent in 2010, but then up by between 0.3 and 0.5 percentage points in each of 2011, 2012 and 2013. Overall, the Blue Book has revised up cumulative GDP growth since the low point of the late 2000s recession from 11.2 to 12.1 per cent.

Thus, with nothing positive having occurred in the real economy to change the overall picture – on the contrary, the indicators have generally been more cautionary – the ONS’s upward revisions in the baseline for GDP by a stroke are deemed to justify more headroom for deferring spending cuts till now deemed essential (so the Chancellor had told us) for the nation’s economic security.

But the OBR used this ONS “card” to spin things further – they have changed the assumed profile of GDP future growth in a way that, coincidentally, helps Mr Osborne politically. They have revised their estimate of GDP up a notch for the next two years – from 2.3% to 2.4% and 2.4% to 2.5% respectively, which affects the near-term debt-to-GDP ratios. They then slightly downgrade the GDP estimate for later years (from 2.4% to 2.3%) but in a way that causes no pain for Mr Osborne.

The justification for upgrading the near-term estimate is modest indeed – they note that “GDP growth in advanced economies in the second quarter of 2015 was below our July forecast” and that UK Q2 GDP grew at a slower rate, but argue

In 2016, that [the rise from 2.3% to 2.4%] mainly reflects the Government’s decision to ease the pace of fiscal tightening. In 2017, the revisions to underlying potential output growth are more important.

That is, they have increased GDP precisely because of the government cutting less next year – explicitly recognition that there is indeed a multiplier effect – that government cuts do indeed reduce economic activity!

But increased tax receipts and increased estimates of GDP future growth are not the only changes in assumptions that happened, so fortunately for Mr Osborne, to ease his fiscal path. The biggest positive change comes from another source – reduced interest payments.

In Table 1, we show the respective changes from the OBR’s July estimates (taken from the OBR databank at that point) to their new November estimates.

This shows that, over the current Parliament (i.e. excluding 2020/21) the financial gain from the changed debt interest payment estimates are just as great as the gains from assumed higher tax take. Indeed, over this year and next, the lowering of estimated interest payments is the major factor – the lower interest charges are by themselves almost exactly equal to the upward move in Total Managed Expenditure (TME)!

This is an extraordinarily large change – from July to November – to slip through as a kind of technical change, representing over half of 1% of GDP per year (i.e. over £10bn a year) – and an annual reduction of around 30% in what they had previously estimated!

Yet the OBR, in its Executive Summary, merely says:

Spending on debt interest is also lower in all years, reflecting a further fall in market interest rates.

It turns out that to a significant extent, the change is due to a third card being played by Mr Osborne (and the OBR) – the Bank of England card. The OBR put it like this

the Bank of England announced in November that it would keep the stock of gilts held in the Asset Purchase Facility (APF) at £375 billion until Bank Rate reaches a level from which it can be cut materially. The MPC currently judge this to be around 2 per cent – a level that markets are not pricing in until beyond our five-year horizon. This reduces debt interest spending (and thus borrowing). But it also increases PSND [public sector net debt] because the nominal (as opposed to the market) value of the gilts the APF holds exceeds the value of the reserves the Bank created to purchase them…,[This] adds increasing amounts to PSND, reaching £18 billion by 2020-21. (Netting off the debt interest saving, the total increase in PSND is £12 billion).”

According to Chris Giles in today’s Financial Times, the effect of this wheeze to the current budget is a gain of about £2 billion a year – the price for which is an increase in public debt, a nice way to fix the roof! If Chris Giles is right, this still leaves a huge residual lowering in the OBR’s interest assumption, whose rationale I cannot find explained, save laconically here:

debt interest spending has been revised down significantly, due to lower market interest rates and the effect on our forecast of the Bank of England’s announcement that it would keep the stock of gilts held in the Asset Purchase Facility at £375 billion until Bank Rate reaches a level from which it can be cut materially..

But what this means is that interest rates are now assumed to be so low – for 5 years ahead – that the (already economically silly) case for “paying down the debt” totally disappears since there is no gain to the public finances from so doing. The government can borrow at almost zero per cent rates, and annual interest payments as a percentage of GDP have hardly ever been as low as the OBR assumes.

In summary, the Chancellor has used estimated windfall gains, from the ONS’s changes to GDP, the Bank of England’s decisions on the Asset Purchase Fund, and above all from the OBR’s new-fangled optimism, to justify his slower path to the same final objective – a permanent reduction in the UK state’s role in society, represented by the achievement of an even larger budget surplus at the end of the road.

A surplus that has zero economic justification, since (for example) simply balancing the current budget (leaving investment for long-term investment) would get rid of all the major future budget cuts, while still leaving the debt to GDP ratio on a downward path.

At the same time, Mr Osborne has gone along with increasing public debt (which he has so long lectured us will destroy us all) as the price for politically easing his way to a purely political, not an economic goal.

The Chancellor has tried play a confidence trick on us all – using the cards marked ONS, BoE and above all “OBR”. We shouldn’t fall for it.

Annex

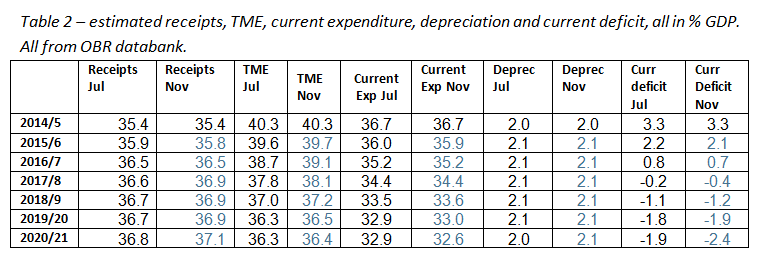

I have put together two more Tables, comparing the OBR’s estimates in July and in November, so that readers can see what has changed.

Table 2 sets out the changes in receipts, expenditure, depreciation and the current (not overall) budget deficit, all as percentages of GDP.

Table 3 looks at the debt stock position, in both nominal and real (2014/15 constant price) terms. We should recall that by ONS reclassification, Housing Association debt now counts as “public” debt, and adds about 3%, or around £60 billion, to the previous total. Nominal debt rises each year of this Parliament, and is estimated to be some £109 billion higher in 2019/20 than in the current year.

In real terms (allowing for inflation) debt would peak in 2017/18 and fall back thereafter, being around £13 billion lower in 2019/20 than in the current year.