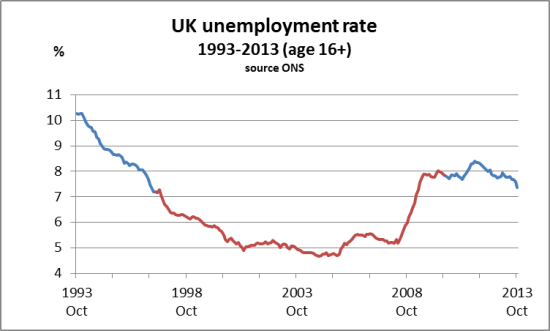

The UK economy has – in terms of GDP – performed somewhat better in 2013 than almost all analysts expected. That includes us in PRIME. But the “growth” – which looks like being around 1.75% year on year – is nothing like as large or as entrenched for the future as many commentators want to persuade us. It comes after a year (2012) of utterly dismal economic performance, due largely to the austerity policy of the government, in which real GDP per head of population fell again, with GDP rising by just 0.25%.

But here we go again. Chancellor George Osborne tells us – 16 months ahead of the next General Election – that we must cut public spending by a further £25 billion after the election. Whatever the state of the economy. The problem, he claims, is public spending. Yet the austerity policies pursued – though not as severe as the Eurozone’s masochistic policies – have contributed directly and significantly to the UK’s weak economic performance till mid 2013.

Let us travel back in time to February 2010, less than 3 months before the last General Election. George Osborne delivers the Mais Lecture. In it he says:

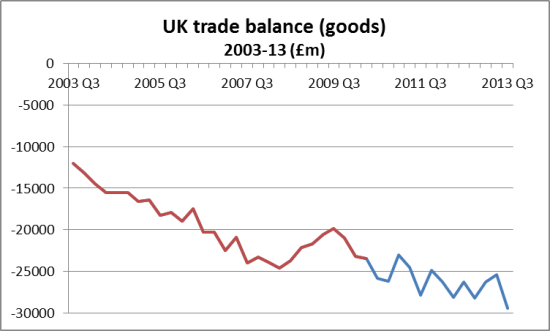

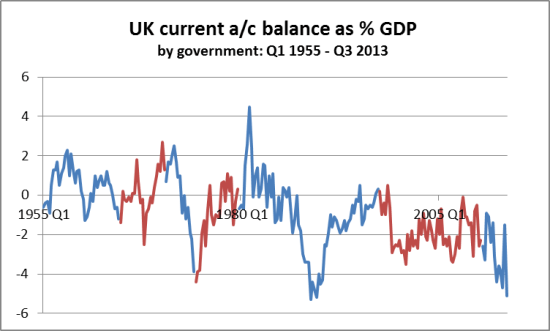

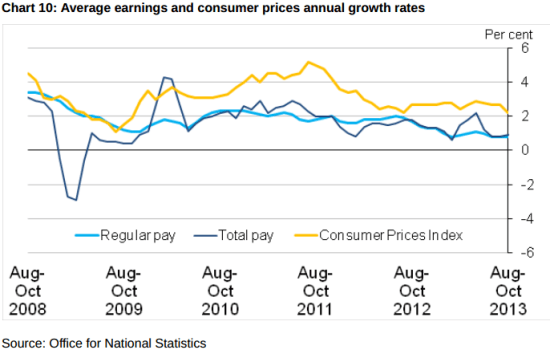

“We have to move away from an economic model that was based on unsustainable private and public debt. And we have to move to a new model of economic growth that is rooted in more investment, more savings and higher exports.”

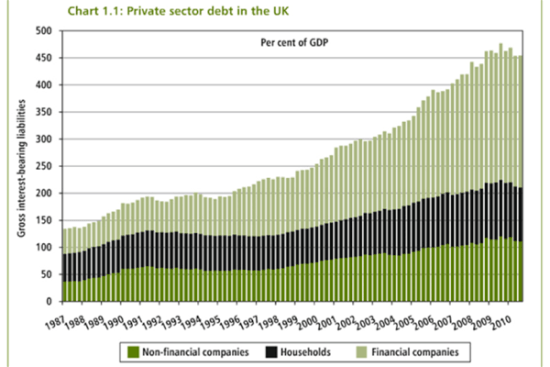

First, note that – at that time – Mr Osborne was rightly concerned about the level of private debt as well as public debt. While private debt has slightly declined, the ‘deleveraging’ has been modest over the last 3 years. But ever since he became Chancellor, he and his government have turned a blind eye to private debt, concentrating solely on public debt.

And as regards more investment and higher (net) exports, well, see below.

So the big question is whether the ‘new’ economic model promised has been ditched in favour of, well, the old economic model – and indeed whether either model is right for Britain today.

BBC Business Editor Robert Peston puts it nicely today in his blog:

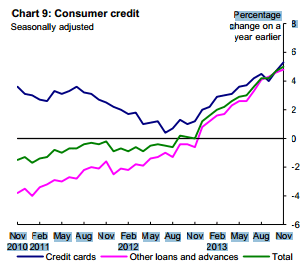

“Households are behaving in a way that Keynesian economists say the chancellor should have been acting. And the chancellor has on the kind of hair shirt that consumers should perhaps still be wearing, given that they went so spending and borrowing bonkers in the boom years.”

Let’s look a bit deeper.

GDP and Gross Value Added (GVA)

First, let us look at the main components of GDP, from the 3rd Quarter 2013 ONS statistics, to see what has and what has not changed significantly since the General Election in 2010. 2010 as a whole is used as the baseline index (=100) by ONS, so this provides a reasonable proxy for the comparison.

For the record, GDP in 2010 rose by 1.7%, in 2011 by 1.1%, and in 2012 by…[drumroll] 0.25%. It seems that 2013 will be roughly the same as…2010.

On the production side, we find that Gross Value Added has increased by 3.9% over the 3 year period to Q3 2013 – an average of 1.3% per year.

Of this 3.9% increase in GVA over 3 years, some two-thirds (+2.1%) is attributable to the “output” of the broad service group “professional, scientific and administrative”. This is therefore, by a large margin, the most important change over the period.

Wholesale and retail trade accounted for 0.7% of the increase in GVA, transport storage and communications for 0.3%, and real estate for 0.5%. On the other hand finance and insurance have made a negative contribution of -0.3%.

Within the mainly public sector areas, education has contributed 0.25% and health and social work 0.6% to the increase in GVA, partly offset by the negative contribution of public administration, -0.4%. This still means that public services have made a positive contribution to GVA.

Manufacturing has made no contribution to the increase in GVA so far, whilst construction has reduced it by -0.1%, and mining oil and gas extraction has subtracted -0.6%.

Due to increases in spending on health in particular (and due to a more doubtful statistical assessment of the deflator for public services), overall general government consumption expenditure appears to have risen over the 3 years, roughly by the increase in population (around 0.8% per year). Household expenditure has risen by a little more (around 1%) than the increase in population.

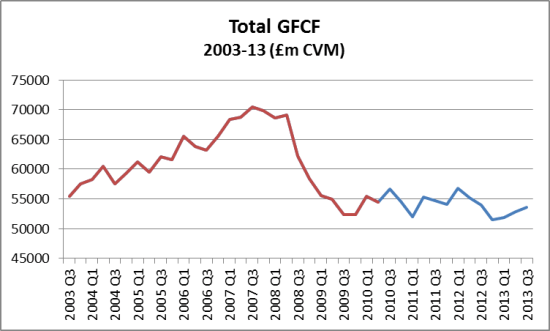

But gross capital fixed formation – private and public combined – shows an actual fall over the period since the last General Election. Despite the fact that in 2013 it has risen slightly each Quarter, total GFCF in Q3 2013 remains below the level of 2010 and most of 2011:

UK GFCF 2003-13 Q3

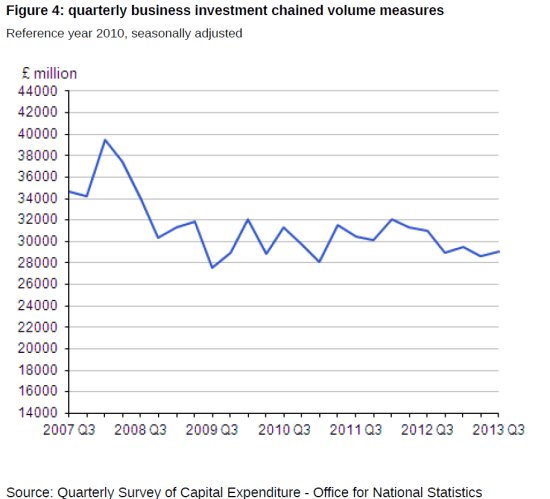

And the next chart, from ONS, gives the picture for business investment, one of the elements highlighted by Mr Osborne in the Mais lecture:

bus inv to Q3 2013 chart

2 Responses

It is not at all clear whether you are using GDP per head in this article apart from the membetion of the GDP per hhead in the first paragraph. with pop rising at 400,000p.a the inclusion of per head figures is vital and needs to be muchmore explicit. Douglas

It is not at all clear whether you are using GDP per head in this article apart from the nention of the GDP per hhead in the first paragraph. with pop rising at 400,000 p.a the inclusion of per head figures is vital and needs to be much more explicit. Douglas Other wise a great article Thanks .