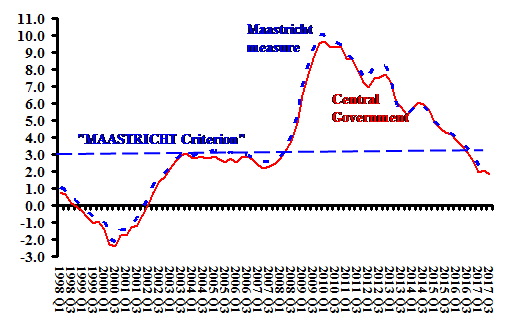

Anyone familiar with the austerity obsession of EU leaders will know that the boundary between fiscal virtue and profligate sin lies at minus 3%. A budget balance below the ominous minus 3 sends the offending government to the fiscal headmasters of the European Commission, who enforce the dreaded “excessive deficit procedure”. Demonstrably absurd, dysfunctional and a major explanation of the long delayed and tepid recovery of the euro zone (see our report), the 3% austerity solution is too lenient by half for the Institute for Fiscal Studies (literally, numbers in charts below).

In its latest true-to-form report, “Between a rock and a hard place”, the IFS discovers to its horror that the Tory Chancellor badly missed his borrowing target and is unlikely to balance the central government’s budget. Apparently gobsmacked by the report, the Guardian reproduced many of the IFS charts, sounding the alarm of a “new budget black hole”, its default moniker for a fiscal deficit (a singularly misleading cosmological metaphor as a trip to the NASA website shows).

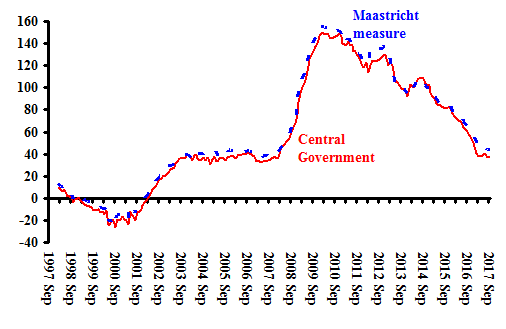

An inspection of British government statistics suggests that for all the fiscal high crimes and misdemeanours over the last seven years, the Tory Chancellor is not “between a rock and a hard place” with government finances. The chart below shows annualized borrowing over twenty years by month (ie., the moving sum of twelve months borrowing).

After an almost continuous monthly decline over the last three years, public borrowing, both for the central government and all governments (Maastricht measure), has fallen to about the level just prior to the Great Financial Crisis of 2008. Adjusting for inflation over those twenty years annual borrowing would show a substantial reduction compared to 2007-2008.

Annualized Public Sector Borrowing, Sept 1997 – Sept 2017, billions

Notes: Annualized borrowing is borrowing for the twelve months including the current month. The Maastricht measure includes local government.

Source: Office for National Statistics

2 responses

Why the BBC Today programme sees the IFS as the go to authority on Government spending is beyond me. I thought they had a remit to be impartial.

Great article. Couldn’t have taken the mick out of the IFS and Guardian better if I’d tried.