Thomas Piketty has now published his detailed reply (dated 28th May) to two withering attacks by Chris Giles, the Financial Times’ economics editor, on his data and use of data, in particular in relation to the proportion (over time) of wealth-ownership of the top 1% and 10%. On most points, Piketty has answered the points in a reasonable (and to me generally persuasive) way. But the way Chris Giles kick-started the debate, it was clear that this is not simply an economic issue and battle, but a political one too.

So no doubt the argument will continue, with left and right contesting the terrain. But has the quite personalised form of attack by the FT’s Economics Editor had the effect of damaging his newspaper’s reputation for even-handedness and objectivity?

In his second detailed article (also dated 28th May), Giles seeks to defend himself against the argument that he has “an agenda”. Here is what he says:

“Many people online have suggested that the articles were a premeditated attack on Prof Piketty, with suggestions that the FT’s motives were in making a splash a political agenda. While the FT likes making a splash – it is a news organisation – the true motivation is much more mundane and clearly documented. On 15 May, Britain’s Office for National Statistics released data on wealth inequalities and editors asked me for an international comparison. I reached for Prof Piketty’s book as a reference guide, but realised I could not use its comparisons because the British data he used were so different from the ones in the ONS study.”

Let me be clear – Chris Giles is an excellent and assiduous economist and journalist; he often gives strong and controversial opinions which resonate in the political domain, and which have broadly supported conservative economic positions. So he should not be surprised that many do indeed suspect that he is guided – consciously or unconsciously – by an inner ideological lodestar. And the fact is, he has long been amongst the stoutest defenders of the austerity policies pursued by Chancellor George Osborne, e.g. this piece (April 26, 2013) “Austerity is hurting – but is it working?” where (in a debate with Robin Harding) he poses the issue thus:

“it is just as wrong to say deficit reduction does not hurt (it does) as it is to imagine stimulus generates so much additional economic activity that profligacy pays for itself.”

To reduce this debate to “deficit reduction” versus “profligacy” – a term of abuse directed to all forms of Keynesian policy initiatives – veers a long, long way from neutrality. And Giles’s admiration for George Osborne’s policies is pretty explicit here “A rhetorical victory lap over the UK economy is justified” (For those barred by the FT’s paywall, the title tells it all!).

It’s the General Election, stupid!

Back to Piketty. On 15th May, before this whole debate began, Giles co-authored an article with Emily Cadman, “Family fortunes lead political battle over equality” in which he said this:

“The question of who owns what promises to be a defining issue of next year’s general election. One key issue is whether the UK is destined to become ever more unequal – as predicted by Thomas Piketty in his book Capital in the Twenty-First Century.” (my emphasis).

And just a few days later, on May 23rd, he launched his first guided missile against an important part of Piketty’s work – having given the author less than a day to respond to a volume of detailed points. In a summary article, “Piketty findings undercut by errors”, he says:

“Thomas Piketty’s book, ‘Capital in the Twenty-First Century’, has been the publishing sensation of the year. Its thesis of rising inequality tapped into the zeitgeist and electrified the post-financial crisis public policy debate.

But according to a Financial Times investigation, the rock-star French economist appears to have got his sums wrong.The data underpinning Professor Piketty’s 577-page tome, which has dominated best-seller lists in recent weeks, contain a series of errors that skew his findings. The FT found mistakes and unexplained entries in his spreadsheets, similar to those that last year undermined the work on public debt and growth of Carmen Reinhart and Kenneth Rogoff.

The central theme of Prof Piketty’s work is that wealth inequalities are heading back up to levels last seen before the first world war. The investigation undercuts this claim, indicating there is little evidence in Prof Piketty’s original sources to bear out the thesis that an increasing share of total wealth is held by the richest few.” (our emphasis)

This is sharp and effective journalism, but not unbiased journalism. It is attack dog Daily Mail style, calculated to damage the reputation of the adversary. But it is at variance with the FT’s usually even-handed way of dealing with controversy, and was followed up with an editorial – in less virulent terms – premised on the assumption that Piketty was materially wrong.

I believe, in short, that the FT and Mr Giles have handled this affair badly and unfairly through what looks like an ad hominem attack with a political dimension – and that many others also see this. That cannot be good for the FT’s reputation, even if it helps with short-term sales.

The contested issues

Of course, the key question is – apart from the evident animus behind the attack – whether Giles’s points have real substance, in the sense of undermining the logic of Piketty’s case. For the most part, the answer is no – and for the rest, there is as yet no clear evidence that Giles is right and Piketty wrong. On the contrary, the weight of material evidence tends broadly in Piketty’s favour.

For example, Giles’s critiques of Piketty’s data and charts for wealth holdings in France and Sweden come to frankly nothing at all – the charts before and after Giles’s proposed changes are not materially different from the author’s.

Weighting for Sweden?

He also criticized Piketty for averaging the wealth data between France, UK and Sweden to represent “Europe” without weighting for Sweden’s far smaller population. Here it is fair to say that Piketty made a major – but fairly explicit – leap to take just 3 countries to represent the continent. One can contest this as methodology, but it is not hidden from the reader. But taking an average of UK, France and Sweden weighted to take account of Sweden’s far smaller population – as Giles argues should have been done – would not have helped in any way, since it would mean that the UK and France in effect doubled up to become proxies for the rest of Europe. Whereas Piketty clearly uses Sweden as that proxy, having anyway shown that the data in Sweden showed a similar trend. Giles’s argument about weighting has no merit in the actual context.

The US and UK

His main criticisms which might if all correct have a real impact on Piketty’s argument relates to the US and UK. In relation to the US, the substantive dispute is over the level and direction of wealth holdings by the top 1%, since the figures for the top 10% remain almost untouched by Giles’s criticisms.

I have no basis in knowledge to judge the merits of the respective arguments on the 1% (see Piketty’s own response on this), save to point out that it is obvious to the whole world that the über-wealthy have access to myriad ways of masking their wealth from the authorities, so any official data are almost certain to be a vast underestimate in an age of unregulated capital flows. Piketty has answered the point, as have others, including drawing attention to other evidence of the growth in the proportion of wealth held by the wealthiest layer of the population.

On the UK, Giles argues that Piketty has greatly overstated or over-estimated the share of wealth attributable to the top 1% and the 10% – and by use of incorrect or unjustified data, wrongly drawn the conclusion that their shares of wealth are once again increasing. He in particular argues that the ONS’s Wealth and Assets Survey (the most recent of which was released in May 2014) is the best available data, and shows much lower percentage figures for top wealth-holders.

The ONS Wealth and Assets Survey

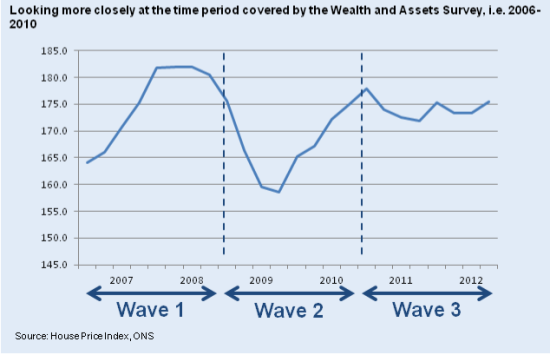

The first Survey was for 2006-08, the second for 2008-10, and the third for 2010-12. Thus when writing his book, Piketty would in any event have had access only to the first two, i.e. not a long run series. Moreover, the 2nd survey covers a period of financial crisis when asset values lurched violently so that different cohorts surveyed at different times would give quite different values, diminishing its value as a snapshot. Here is ONS’s own chart showing this for house prices:

ONS wealth survey chart

And here is the FTSE 100 which demonstrates the peaks and troughs in recent years indicative of the lurching value of financial assets during the 2006-2010 period, amongst others.

FTSE 1985-2014

3 Responses

i don’t know why all the fuss over Picketty,what he says has beeen known by many,what he has done by using stastiics and economic history show how the rich get richer and the poor, poorer,which is exactly how capitalism works if left alone from government interference.

Any body who has read Keynes or Galbraith know this,both wanted capitalism to benefit all not just the minority

I have to agree with Neil Wilson for the same reasons. The quality of financial / economic journalism in the UK is abysmal. The parade of corporate economic pundits, starting on Radio 5 at 05:15, “talking up their books”; doesn’t get any better throughout the day on UK mainstream media. Re-cycling corporate press releases seems to be the norm. Even worse, we have a bunch of politicians who know even less about economics. They all still think we are on the Gold Standard back in Victorian times.

Still, we Brits have to be thankful that we are not in the Eurozone, suffering “troika” style austerity, that was probably out of date when we were living in caves.

“The issue is one of power of the very wealthy, and the access to leverage to impose that power.”

And that is why trying to pretend that you can extract the politics from ‘political economy’ is in itself a political act.

All economics is political – because it boils down to wealth and power.