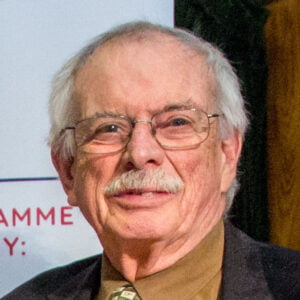

On 5th January 2018, Professor John Weeks gave this year’s David Gordon Memorial Lecture

at the meeting of the American Economic Association in Philadelphia, USA. It was hosted by the Union for Radical Political Economics, and we are pleased to publish the text of the lecture, below. It can also be downloaded as a pdf here.

David Gordon was an American economist who inter alia founded the Institute for Labor Education and Research in 1975, and later the Schwartz Center for Economic Policy Analysis in New York City. He worked to disseminate progressive economic ideas to the general public.

Preface

We gather today in the year marking the 50th anniversary of the Union for Radical Economics and of the first issue of the Review of Radical Political Economics in which Michael Zweig and I had the lead articles, a publication with the rather modest appearance of coming straight off the mimeograph machine – if there is anyone here that remembers such primitive print technology.

In the context of that anniversary it is a great honor to deliver the David Gordon Memorial Lecture, all the more so because the theme I develop will draw on insights in his work, especially in his last book, Fat and Mean: The Corporate Squeeze of Working Americans and the Myth of Managerial ‘Downsizing’ .

The honor is all the greater when I reflect on previous speakers in this series, which reads like a roll call of the intellectual leaders of progressive economics: Dean Backer, Juliet Schor, Tom Weiskopf, Duncan Foley, Nancy Folbre, Minqi Li, Gerry Epstein, Bill Darity, Jim Stanford, David Laibman, Ann Markusen, Michael Perelman, Doug Dowd and Bob Pollin. Those who have preceded me set a tradition of excellence and that impressive tradition inspires me today. I thank those involved in the selection process and thank you for joining me.

Discussions with many people helped me clarify my ideas. Among these I mention without assigning blame, Ann Pettifor, Jeremy Smith, Stephanie Griffith-Jones and Susan Himmelweit. Finally, I thank the Ford Foundation for its support for this work.

Introduction: Neoliberal Authoritarianism

Well into the twenty-first century it is difficult to find a major country in which democratic institutions are not under stress, in many cases under aggressive attack. In the United States the government has fallen under the control of a profoundly anti-democratic regime. In Europe long-standing authoritarian tendencies have enjoyed a quantum leap under the neoliberal austerity regime fostered by the German government with the cover of the European Commission.

The draconian austerity measures that were imposed on Greek citizens represent an obvious and shocking example of the mainstream authoritarian trend in Europe. Authoritarian movements and political parties hold power in Poland and Hungary. Successive elections in the last four months of 2017 brought a surge of far-right movements: 1) neo-fascism in Germany that deepens the crisis of the centrist parties; 2) near elimination of the centre left and a hard-right government in Austria; 3) imposition of direct autocratic rule in Catalonia by the right wing Spanish government; and 4) the electoral triumph of a hard-right billionaire in the Czech Republic. Outside the EU, the efforts of the government of Europe’s most populous country, Russia, to undermine democracy domestically and in the rest of Europe are well-documented.

The few developments supportive of democracy come in Spain where progressive and participatory Podemos is the second strongest political force; the shift of the British Labour Party to social democracy and the imminent possibility of an election victory. These sources of hope guide and inspire progressives in Europe, but have yet to move into government.

Beyond North America and Europe no major country counters the authoritarian trend, not China, where the government oversees a transition from socialist to market authoritarianism. Superficial flowering of democratic participation in Brazil and India proved short-lived, with a rightwing semi-legal coup undermining representative institutions in the former, and the ruling government in India fostering ethnic-religious intolerance. In Viet Nam where I have worked for 25 years, an authoritarian government has completed the transition from central planning to capitalism though slightly less repressive than in China. In the Philippines, its democratic institutions dubious in the past, now suffer under the most brutal regime in Asia.

What is its source of this near universal 21st century tendency to authoritarianism? The end of WWI, now 100 years past, ushered in the rise of authoritarian regimes provoked by the excesses of capitalism. The Great War, as my parents named it, was the most catastrophic conflict in human history. Ten years later came the most devastating economic crisis the world had known. The excesses of capitalism and the apparent incapacity of representative governments to contain those excesses induced many, especially in Europe, to dismiss “bourgeois democracy” as degenerate and dysfunctional. As the Great War ended, revolutionaries in Russia overthrew capitalism and pledged a governance system in the interests of the working-class and peasantry. The promise and hope for popular democracy went unfulfilled as the workers’ state transformed into thinly disguised authoritarian rule.

In Italy and Germany discrediting of “bourgeois democracy” led to unabashed dictatorships that celebrated their authoritarian nature. The regimes proved appallingly successful not only in crushing labor movements but also in rolling back the principles of the Enlightenment. Destruction of these savage regimes required a war even more catastrophic than the 1914-1918 conflict.

In the wake of economic depression, fascism, war and consolidation of the Soviet Union whose military had borne the major burden of the war against fascism, there developed a near-consensus among mainstream political parties in the United States and Europe. Over thirty years of economic catastrophe, dictatorship and war demonstrated even to major elements of the capitalist class the need to manage capitalism. During its brief life this consensus maintained that stability and consolidation of capitalism required control mechanisms to prevent the excesses of the economic system, excesses generated by competition, what Marx called “the inner nature of capital”.

In the immediate aftermath of WWII this recognition of the excesses of capitalism appeared even in the foremost economics journal of the time, The Economic Journal. In 1947 the British economist K. W. Rothschild wrote an article that I hope is on the reading list of every progressive course in microeconomics,

…[W]hen we enter the field of rivalry between [corporate] giants, the traditional separation of the political from the economic can no longer be maintained… Fascism…has been largely brought into power by this very struggle in an attempt of the most powerful oligopolists to strengthen, through political action, their position in the labour market and vis-à-vis their smaller competitors, and finally to strike out in order to change the world market situation in their favour…

…[A] theory of [competition] can be complete and relevant only if its framework includes all the main aspects of the struggle [by corporations] for security and position. Like price wars, open imperialist conflicts will not be the daily routine of the oligopolistic market. But, like price wars, their possibility and the preparation for them will be a constantly existing background…And the imperialistic aspects of modern wars or armed interventions must be seen as part of a dynamic market theory just as the more traditional ‘economic’ activities like cut-throat pricing…For there is no fundamental difference between the two.[1]

The rise of financial capital, which began in the 1970s, has returned us to the capitalist authoritarianism that flourished in the 1920s and 1930s. As Rothschild argued 70 years ago, market competition is the source of authoritarian rule, and by its nature competition among oligopolies extends into social and political conflict. It is too narrow and insufficient analytically to treat competition – the movement of capital – as exclusively or even primarily an economic process.

The current authoritarian tide in European and the United States comes from the excesses generated by capitalist competition, unleashed and justified now not by fascism but by neoliberalism. Neoliberalism pretentiously claims to be the guarantor of freedom – “free markets, free men” was the title of Milton Friedman’s infamous lecture to London businessmen in 1974 (Friedman 1974). Reality is quite the contrary. Neoliberal market re-regulation over the last thirty years has destroyed freedom.

I am careful to use the term “re-regulation” not “de-regulation”. During the New Deal period, and during the European post-war social democratic and Christian Democratic consensus, governments regulated capital in the specific sense of limiting its freedom of movement. Tariffs, non-tariff “barriers”, limitations on conversion of national currencies and strict oversight of financial institutions constrained the form and intensity of competition. The explicit purpose of these policies was to prevent the “free flow of goods”, to restrict capital’s cross-border mobility, and narrowly contain financial speculation (Keynes 1933).

The neoliberal re-regulation does not reverse that process. The neoliberals do not stop at eliminating competition-restricting regulations. Neoliberal re-regulation replaces them with different legal rules, ones that actively facilitate the collective power of capital and undermine the collective power of labor. Neoliberal re-regulation is not the negation of restrictions on capital.

Rather, it is the implementation of active policies to limit the scope for governments to act and intervene in economic, social and political spheres. During the New Deal and social democracy in Europe governments regulated capital. In the neoliberal era capital regulated government.

The result is not “small government’. The central purpose of the neoliberal re-regulation is to remove economic policy from control by representative democracy. This requires not only explicitly economic re-regulation but also social and political re-regulation. Perhaps the clearest example of enforcing limits on representative government is the right-wing German economic ideology “ordoliberalism”. The term combines two words, “order” and “liberalism”. This is not a philosophy of de-regulation; rather it is a philosophy of restricted democracy that advocates strict rules – “order” – to limit governments from enacting legislation that deviates from neoclassical principles.

Its combination of neoclassical economics and emphasis on the state establishing rules to enforce that ideology yields an explicitly anti-democratic system of governance, now deeply embedded in the two major treaties that serve as the constitution of the European Union. The current German government has spent over a decade successfully inducing other EU governments to legislate limits on their legal scope to design and implement economic policy. Examples of the ordoliberalism approach in the United States are the legislation setting the public debt ceiling and central bank inflation targeting.

The most odious re-regulation in the interests of capital has been legal measures to weaken trade unions and other popular organizations and movements. Central to that weakening has been the consolidation of financial capital’s control of the media, itself facilitated by legal changes. This control of the means of communication is central to the re-regulation process that liberates capital. Media control facilitates the propaganda to minimize and deflect criticism, even recognition, of the criminal excesses of capitalism.

Imposing legal and extra-legal limits to personal freedom in the neoliberal era derives both ideologically and in practice from the dogma of market freedom. Adam Smith’s ahistoric view that markets arise as a “consequence of a certain propensity in human nature…to truck, barter, and exchange one thing for another” could not be further from the reality of capitalism. So-called free markets must be enforced, enforcement achieved by the re-regulation of capital. Over the last forty years this re-regulation involved a decommissioning of representative government while maintaining it as a rhetorical facade.

The active regulation of market processes in the United States in the 1930s and Western Europe after WWII suppressed the authoritarian tendency inherent in capitalism. The re-regulation by capital, especially financial capital that began in the 1970s, unleashed that authoritarianism. The emergence of finance capital, so-called financialization, brings to full expression the anti-democratic nature of market processes.

At the outset of the 21st century the great oligopolies and powerful industrial corporations about which Rothschild wrote no longer drive the destructive force of capitalist competition. Finance capital not the huge industrial predators of the 20th century drive competition in this the globalized 21st century. The hegemony of finance capital brings forth overtly authoritarian political dictatorship undisguised by democratic trappings.

Capitalist Competition & Dictatorship

Before proceeding I clarify a few terms. I employ the word “era”, as in the “era of industrial capital” to mean nothing more than a period of time, not carrying the analytical baggage of “phases” or “stages”. I use the term “industrial capital” to refer to capitalist enterprises that produce objects and services through the application of labor to means of production, with the purpose of selling them. The word “commodity” refers to both produced objects and services.

Services include transport, education and health care, among others. Finally, “financial capital” refers to capitalist enterprises whose reproduction involves the conversion of money into more money without to any substantial extent producing objects or services for the purpose of selling them. With these terms clarified I can proceed.

Finance capital differs from industrial capital in its reproduction. Industrial capital generates commodities, both physical objects and services through the combination of material inputs and labor. Competition among industrial capitalist producers occurs in part through productivity change, “the cheapening of commodities” as Marx described it. While the cheapening of commodities is central to competition among industrial capitalists, it should not be analyzed separately from the broader competitive conflict.

The broader conflict includes intervention of governments in support of capital and the implicit or explicit support of governments for the direct application of violence by capital against labor. I do not mean to imply that corporations remain national. Whatever their nominal registration or geographic location, large corporations in the competitive conflict use governments to enhance their position with similar vigor and frequency as they use measures to lower the monetary cost of the commodities they generate.

Therefore, we should not think of the competitive struggle as primarily an economic process with occasional intrusion by government; rather, it is a conflict in which economic and political factors are integrated. For example, much of the negotiations in the European Union over the so-called deepening of economic integration involve large corporations using governments to achieve competitive advantage, with German governments over the last three decades perhaps the most skilled at this process.

Productivity increases can serve as a major, even primary instrument to enhance the competitive position of industrial capital. This is not the case for financial capital, whose reproduction does not require production of material objects or services that require monetization. As for the classic rentier, financial value added accrues as an extraction from the value added generated in production of commodities. In essence it functions as a private sector tax on the production of commodities.

In consequence, the enlistment of government intervention in the competitive conflict, always important for industrial capital, provides the only vehicle for financial capital. Unable to engage in the “civilized warfare of the cheapening of commodities” (Marx 1974, 668), financial capital must engage governments as its continuous and constantly intervening partners.

In the era of industrial capital the possibility exists for progressive regulation of competition that confines the competitive conflict to that “civilized warfare” based on technologically driven productivity increases, primarily achieved through investment in fixed capital. This arrangement has not been nor will it ever be one chosen by capitalists. It must be forced upon them by the political strength of labor and popular movements.

That progressive outcome is unacceptable to financial capital, ideologically and, more importantly by the nature of its reproduction. Its reproduction lacks to any substantial degree the ability to lower costs through greater productivity, which is the basis of “civilized competition”. The attempt by a government to restrict financial market competition to its economic components would – and will – destroy financial rents and reduce financial capital to an organ serving industrial capital.

Decommissioning Democracy

As many have argued financial capital is not anti-government, but seeks to reconstruct, or to use a favorite neoliberal term to “reform” governments. This reform consists of establishing restrictions on what governments can do. Analogously to the beginning of the First Amendment, “Congress shall make no law”, financial capital seeks its own Bill of Rights, with its amendments beginning “Governments shall take no action to limit the movement of capital”. The implied prohibitions on government actions decommission electoral democracy.

The purpose of destroying the post war regulatory consensus was to liberate financial capital from constraints. The macroeconomics of Hansen (1949), Keynes (1933), and Kalecki (1943) provided both the theoretical explanation for why these constraints were needed and the practical policy tools to manage an economy within those constraints. The “Keynesian revolution” briefly institutionalized the sensible principle that representative governments have policy tools they can use to pursue the welfare of the populations they were elected to serve.

The most important of these for macroeconomic management were fiscal policy, monetary policy and management of the exchange rate. The Tinbergen Rule provided a complementary sensible proposition, that to achieve several policy goals requires an equal number of policy instruments.[2] For example, a government seeking internal and external stability would use fiscal policy to reach a high level of employment and output, monetary policy to make that unemployment rate consistent with desired inflation rate, and adjust the exchange rate to maintain a sustainable balance of payments.

The obviously sensible proposition that governments should use the tools available to them to pursue the public welfare, while enforcing constraints on the excesses of capitalism, has been discredited by repeated ideological attacks gathering pace in the mid-1970s. The constraints would be dismantled and tools de-commissioned by increasingly neoliberal governments. The mainstream economics profession has provided the ideology for the de-commissioning of the policy tools and support constraints on the popular will.

Active, discretionary use of policy instruments in these three areas established barriers to the hegemony of financial capital. Public taxation is in direct competition with the private tax function of financial rentiers. Monetary policy in support of an active fiscal policy limits the extent that central banks can service the needs of financial capital. Fixed exchange rates and more generally government managed exchange rates undermine one of the largest sources of financial speculation. To achieve its hegemony, financial capital required a deactivation or decommissioning of public policy instruments.

Negating Fiscal Policy

Until the Great Depression of the 1930s, macroeconomic policy in the advanced countries meant monetary policy and not much of it. Exchange rates were tied to an international gold mechanism and the goal of public budget balancing constrained fiscal policy. Fiscal policy was used by a few governments during the depression, notably in the United States, but in an ad hoc manner. The first clear legal commitment to an active fiscal policy was the US Full Employment Act of 1946, the preamble of which states,

The [US] Congress hereby declares that it is the continuing policy and responsibility of the Federal Government to use all practicable means…with the assistance and cooperation of industry, agriculture, labor, and State and local governments…to promote maximum employment, production, and purchasing power.

Mainstream economics has provided the ideological arguments against an active fiscal policy, giving technical cover for political moves in the US Congress to restrict the federal government from active fiscal policy, such as the Budget Enforcement Act of 1990. The function of this and other legislation to restrict public sector deficits is to remove fiscal policy from the democratic process, however flawed that process may be. The 2007 Treaty on European Union establishes similar and stronger limits on the fiscal policies of EU member governments. Under pressure from the German government the vast majority of the 27 member countries have these treaty provisions written into the constitutions.

The ideologues of financial capital present the de-commissioning of fiscal policy as a technical issue, designed to prevent irresponsible politicians from embarking on “populist” vote-buying expenditures that undermine the general welfare. The populism feared by financial capital is a euphemism for democratic participation and accountability.

Unaccountable Monetary Policy

One of the few progressive aspects of US economic policy institutions is the legislatively mandated political oversight of the central bank, the Federal Reserve System (FRS). The oversight legislation requires regular reports to Congress, and a requirement that the board of governors have “fair representation of the financial, agricultural, industrial, and commercial interests and geographical divisions of the country”. It is important in this reactionary period to stress that inflation is but one of several mandated policy goals of the Federal Reserve System, which reads: “to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates” (Mishkin 2007). In practice the effectiveness of the political oversight has waxed and waned, depending on the chair and politics of the time.

Conventional wisdom holds that in the final decades of the twentieth century the power of central banks increased dramatically in almost all countries, including the United States. The truth is quite the opposite. The role of central banks in most countries, advanced and underdeveloped, narrowed substantially towards the end of the twentieth century. The vehicle for this narrowing was their so-called operational independence, the separation of central banking from political oversight, justified by the argument that without independence, feckless governments will force central banks to pursue reckless monetary expansion to fuel populist fiscal policy.

The so-called independence of central banks is not independence but the transfer of control from elected officials to financial capital. It is profoundly anti-democratic, derivative from the ideologically generated fallacy that monetary policy is a technical matter. In this reactionary framework any democratic oversight would result in reckless and irresponsible policies. As for fiscal policy, monetary decisions are not a matter for public involvement. They should be under the dictatorship of a technical elite that serves the interest of financial capital.

Eliminating Exchange Rate Policy

The ideology of “flexible” exchange rates is as or more central to the health and welfare of financial capital as decommissioning fiscal and monetary policy. At the most obvious level it facilitates currency speculation. More importantly exchange rate instability generates volatility in domestic financial markets. For large economies this volatility can undermine macroeconomic policy goals of governments, and for small and medium size economies the effects can be catastrophically destabilizing.

The instability caused by exchange rate volatility creates an enabling environment for speculation. The speculation itself, in addition to its parasitic nature, is the source of the “judgment of markets” arguments against progressive policies – should a government implement a progressive policy such as increased corporate taxes, capital flight, the “judgment of markets”, can provoke disaster. This constant threat of financial instability represents the anti-democratic nature of financial capital in its purest and most aggressive form, the latent threat of financiers employing their “nuclear option” to prevent progressive change.

In September 2017 the British Labour Party’s “shadow chancellor”, John McDonnell, warned in a speech to the party’s Annual Conference:

What if there is a run on the pound? I don’t think there will be, but you never know, so we’ve got to scenario plan for that. People want to know we are ready and they want to know we have got a response to everything that could happen.

Thus, the person who would/will become the equivalent to the Secretary of the Treasury in the country with world’s ninth largest economy is preparing for the possibility of catastrophic capital flight if/when the Labour Party takes government. And well he should, because in the City of London Britain has perhaps the largest concentration of predatory financial capital on the globe, the world’s largest center for money laundering.

The industrial capitalist can exploit and repress workers, destroy entire communities, even cities, by closing factories and going elsewhere. But the capitalist that owns the means to produce goods and services is a petty criminal compared to financial capital that can destroy entire economies and destabilize the globe.

End of Class Rule by Consent

The wage squeeze has…broader consequences. It not only pinches workers and their immediate families. It sends tremors through entire communities, eroding their stability, ripping their social fabric. The frustration and anger it provokes begins to attack the body politic like a plague, spreading virulent strains of cynicism and discontent, of disaffection from government and hatred towards “others” like immigrants who are often blamed for the scourge.” [David Gordon, Fat and Mean: The Corporate Squeeze of Working Americans and the Myth of Managerial ‘Downsizing’ 1996, 15]

This insight moves me from the decommissioning of democracy in economic policy to the transition of formally democratic countries to overt authoritarianism. By formally democratic I mean those countries with politically contested representative institutions that have functioned recently and could still function as intermediaries between governments and the governed. My knowledge implicitly limits me to North America and Europe and within Europe primarily Western Europe.

In no country in North America or Western Europe has anti-capitalist revolution led to state control. All of them have passed through periods during which progressive forces, led by the trade union movement, have established substantial limitations on the power of capital. A major component of those limitations has been establishing the principle that employees should share equitably in the expansion of the national economy.

In almost every country biases against ethnic groups, gender discrimination and regional animosities have limited the scope of the equity principle to less than the entire population, in some cases far less. In North America and Europe after World War II struggles against the many forms of discrimination sought with varying degrees of success to make the equity principle more inclusive. As incomplete as it might prove in practice, the principle of an equitable sharing of an expanding economy, a key component of the so-called American Dream, provided the basis for class rule by consent.

I use the term “class rule by consent” to describe society with the following characteristics: 1) property relations based on private ownership, which implies that the many work as employees of the few; 2) a trade union movement strong enough to enforce the equity principle through its political influence and its direct action; and 3) as a result of the second, a capitalist class sufficiently constrained in its power that it must accept the equity principle.

For a brief forty years an equitable sharing of the benefits of economic growth, albeit narrowly defined, served as the prevailing ideology in North American and Western Europe. This ideology of equity, interpreted differently among countries, of each person “getting a fair share”, and the realization of that principle in pay packets, is the necessary condition to sustain democracy in a capitalist society.

This condition was the basis for the New Deal Coalition forged by Franklin Roosevelt in the depths of the Great Depression. It would serve as the guiding principle of the Democratic Party through the presidency of Lyndon Johnson. The policies to achieve an equitable sharing had a common theme, restrictions on the functioning of markets to prevent the anti-social consequences of capitalist competition. Concretely these restrictions included 1) trade union rights to limit labor market competition, 2) anti-monopoly laws and other regulations to prevent concentration of corporate power, and 3) strict limits on financial capital.

Neoliberalism was and remains the antithesis of the New Deal political economy. In contrast to preventing the anti-social consequences of market competition, neoliberalism celebrates that competition, attributing any faults of capitalism to public regulation. As the United States entered the twenty-first century, decades of increasing inequality caused falling working class incomes and stagnation for the middle classes. Loss of hope in fulfilling “the American dream” increasingly undermined faith in US democracy. In 1932 an analogous crisis brought Franklin Roosevelt to the presidency to implement economic and social reforms that arrested the growth of inequality and, facilitated working class power through trade unions.

When Roosevelt became president in 1933, US incomes inequality as measured by the most commonly used index, the “Gini coefficient”, was over 50, and into the mid-40s by the beginning of this third term. It fell below 40 by his death in 1945 and was not again above 40 again until 1982 (Atkinson, Piketty & Saez 2011). Fifty years of US capitalism under formal democracy was the historic accomplishment of the New Deal. Relatively low and stable inequality provided the basis for what some call the “Golden Age” of US capitalism. In 1974, by accident under Republican presidents (Richard Nixon, replaced in mid-year by Gerald Ford), US income inequality dropped to its lowest as measured by the Gini coefficient.

Under presidents both Democrat (Jimmy Carter, Bill Clinton, Barack Obama) and Republican (Ronald Reagan, George H W Bush, George W Bush) inequality rose inexorably. Rising inequality revived social divisions subsumed during the “Golden Age.” Donald Trump encouraging and exploiting those divisions is the vehicle, or more appropriately the utensil, for a transition to authoritarian capitalism. With Donald Trump, neoliberalism fulfils its logic, destroying even the illusion of a just society.

Conclusion: The Four Freedoms

Seventy-seven years ago tomorrow [5th January – ed] in his third inaugural address, Franklin D Roosevelt defined the ongoing world conflict as a struggle to protect and guarantee “the Four Freedoms” – Freedom to Worship, Freedom of Speech, Freedom from Fear, and, most radical of the four, Freedom from Want. Forty-five years later on 17 January 1986 heads of governments signed the Single European Act containing its set of Four Freedoms for the European Union, freedom of movement of goods, freedom to bid on government services, and freedom of movement of capital, and the fourth, freedom of movement of people.

European politicians invariably refer to these as The Four Freedoms. FDR’s Four Freedoms were fundamental rights for people everywhere. Whatever the intention, the Single European Act specified a new set of Freedoms appropriate for the neoliberal era – the freedom for capital to move without government intervention; the freedom for capital to sell regardless of origin and conditions of production of commodities; the freedom to privatize (bid for) public services; and the freedom to undercut wages and conditions.

This shift, using the same term to encapsulate freedom for capital that previously captured fundamental human hopes provides a powerful metaphor for our age, from the sublime to the grotesque. An earlier era heralded the hope for human liberation; the current era heralds the liberation of capital.

The struggle for democracy at all levels is the struggle against the liberation of capital. Capital must be placed under permanent house arrest, its freedom severely limited and exercised only under close supervision. The citizens’ arrest of capital will be achieved through a democratic process that would make Roosevelt’s Four Freedoms reality.

Controlling capitalism requires at least the following fundamental reforms.[3] First, because capitalist economies do not automatically adjust to full employment, governments must institutionalize an active counter-cyclical macroeconomic program. The active element in the counter-cyclical program would be fiscal policy, supported by an accommodating monetary policy, and, if necessary exchange rate management and capital controls to facilitate external balance.

Counter-cyclical policies, and many other sensible and humane economic measures, are dismissed as impractical because of the alleged affect they might have on “financial markets”. This personification of markets, universal in the media and appallingly common in the economics profession, is an essential part of the justification of a capitalist economy free from the constraints of democratic oversight. This personification is applied as if the market itself were an independent actor in society.

This ideological abstraction from the real world of speculators and financial fraud is an essential part of the mystification of financial behavior. It facilitates the myth that the dysfunctional financial system is not the work of men and women (mostly the former) within institutions that have socially irrational rules and norms. It promotes the disempowering argument that financial dysfunction is a manifestation of the inexorable operation of the laws of nature that no government can change. It seeks to hide that specific speculators act to coerce governments to take actions in narrow interests of financial capital.

The solution to the hegemony of finance capital is public control through public ownership. In part this could be through direct nationalization, and in part by conversion of financial activities into non-profit or limited profit associations such as mutual societies and savings and loan institutions. Non-profit and limited profit financial institutions have been common in the past.

Third, government regulation of labor markets would be based on the principle in the 1944 charter of the International Labor Organization that “labor is not a commodity”. The purpose would be to eliminate unemployment as a form of labor discipline. The most effective method to achieve this would be a basic income program covering all adults. A properly designed program would facilitate labor mobility, by reducing the extent to which people were tied to their specific employer. Also, by reducing the volatility of household income, it would provide an automatic stabilizer at the base of the economy, the labor market. It would be similar to the automatic stabilizing effect of unemployment compensation, and more effective.

To mitigate the individualist ideology of basic income, programs of public provision of basic non-food necessities should accompany it. These would include a national program of public housing; centrally funded public health service that is rights-based not insurance based, “free at point of delivery”; tuition free education at all levels; and the progressive replacement of environment-destroying private vehicles with public transport. The purpose of these policies is to implement concrete the social democratic philosophy that market provision should be limited, replaced where appropriate by social provision. To varying degrees these policies of social provision appeared in the 2017 Manifesto of the British Labour Party or will appear in the manifest for the next election, now being designed.

Fourth, and the basis for the others, would be the protection of workers’ right to organize. The fundamental reform of capitalism would built on the political power of the working class, in alliance with elements of the middle classes, an alliance based on ethnic, linguistic and gender inclusion. This will be the modern version of the political alliance that brought about major reforms throughout Europe after the Second World War. An effective reform of capitalism that eliminates its economic and social outrages requires a democracy of labor and its allies in which the political power of capital is marginalized.

For 250 years citizens have struggled to restrict, control or eliminate the ills generated by capitalist accumulation: exploitation of labor, class and ethic repression, international armed conflict, and despoiling of the environment. When a progressive majority has allied, this struggle has brought great strides. When capitalists, the tiny minority, have been successful in creating their anti-reform, counter-revolutionary majority much is lost. The last thirty years of the twentieth century and into the twenty-first have been an anti-reform period during which capital achieved a degree of liberation it had not enjoyed since before the Great Depression. With the regulation of government by capital many of the more absurd elements of neoclassical economics, such as the alleged stabilizing effect of financial speculation, manifested themselves in reality.

The Great Depression of the 1930s, quickly followed by the horrors of WWII, generated a broad consensus in the developed countries. This consensus focused on the need for public intervention to protect people against the instability and criminality that results from the accumulation of economic and political power by great corporations. Franklin D. Roosevelt, four times elected president of the United States addressed the US Congress in 1938:

“Unhappy events abroad have retaught us…simple truths about the liberty of a democratic people. The first truth is that the liberty of a democracy is not safe if the people tolerate the growth of private power to a point where it becomes stronger than their democratic State itself. That, in its essence, is fascism.”

We the citizens in the advanced industrial countries, especially the United States and the United Kingdom, have reached the point at which private power is stronger than our democratic state. This private power manifests itself in unconstrained financial greed that over-rides democratic decisions, justified by an ideology of self-adjusting markets. Rejection of that ideology requires radical reform to prevent financial capital from creating fascism. To prevent fascism we must implement a citizen’s arrest of capital that will liberate the many not the few.

Footnotes

[1] Rothschild (1947), p. 319.

[2] Jan Tinbergen shared the 1969 Nobel Prize for Economics with Ragnar Frisch. Jan Tinbergen has the unique distinction of being a Nobel prize winner in a family with another winner, his brother Nikolaas (in physiology).

[3] The four measures are much the same as those in the program of the British Labor Party in 1945, which was more radical than what was implemented during 1945-1951. http://www.unionhistory.info/timeline/1945_1960.php

References

Atkinson, Anthony, Thomas Piketty and Emmanuel Saez

2011 “Top Incomes in the Long Run off History,” Journal of Economic Literature 49, 1, 3–7

Friedman, Milton

1974 “Free Markets for Free Men,” Selected Papers No. 45, Chicago: Graduate School of Business University of Chicago.

https://www.chicagobooth.edu/~/media/917BA065D1914F8F8DF7536680FD7EE7.pdf

Gordon, David

1996 Fat and Mean: The Corporate Squeeze of Working Americans and the Myth of Managerial ‘Downsizing’, New York: Free Press.

Hansen, Alvin

1949 Monetary Theory and Fiscal Policy. New York: McGraw-Hill.

Keynes, John Maynard

1933 “National Self-Sufficiency,” The Yale Review 22, 4 (June), 755-769.

Kalecki, Michal

1943 “Political Aspects of Full employment,” Political Quarterly I, 1

Marx, Karl

1974 Capital Volume I: A Critical Analysis of Capitalist Production. London: Lawrence & Wishart.

Rothschild, R K

1947 “Price Theory and Oligopoly,” The Economic Journal 57, 227 (September), 299-320.

Weeks, John

2012 The Irreconcilable Inconsistencies of Neoclassical Macroeconomics: A false paradigm. London: Routledge.

2014 “Fallacy of Competition: Markets and the Movement of Capital,” in Jamee K Moudud, Cyrus Bina and Patrick L Mason (eds), Alternative Theories of Competition: Challenges to the Orthodoxy. London: Routledge.

2014 The Economics of the 1%: How mainstream economics serves the rich, obscures reality and distorts policy. London: Anthem.