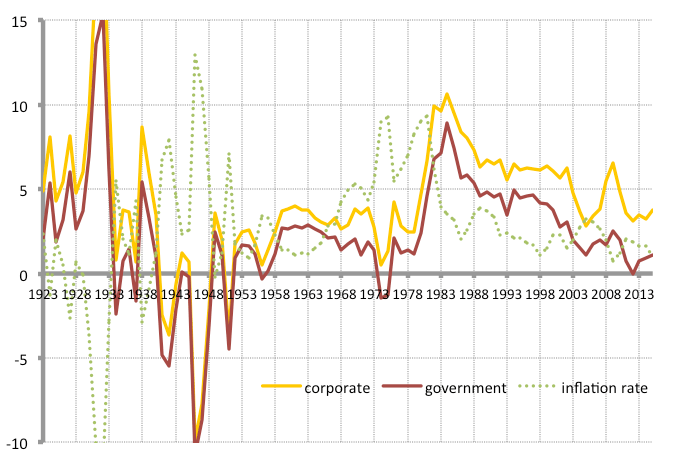

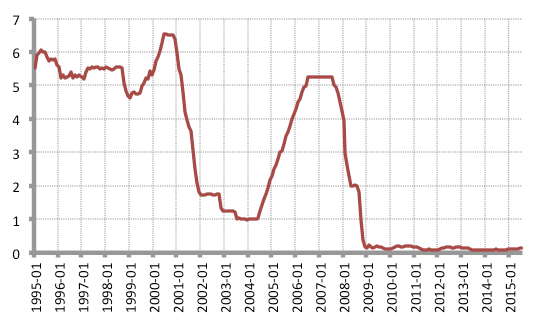

On this basis the 30-year decline is a feature only of nominal rates: real government rates have been falling for 17 years and real corporate rates for 15, though for the latter no continuous decline is evident. The relation with major economic crises should be obvious. The government rate began its material decline from 1998, in the wake of the South-East Asian crisis, Russian debt default and collapse of the hedge fund, Long Term Capital Management. From that point on, US government bonds were a safe haven. The material decline in the corporate rate came at the end of the corporate (dot.com / new-economy) expansion of the 1990s which coincided with the turn of the millennium and the end of the long bull-run on equity markets; the rate fell to 5 per cent in 2001 from 6 per cent in 2000. From that point on, the major shifts in direction have followed policy on the federal funds rate and associated financial interventions, through with an increased spread.

Chart C: Federal funds rate

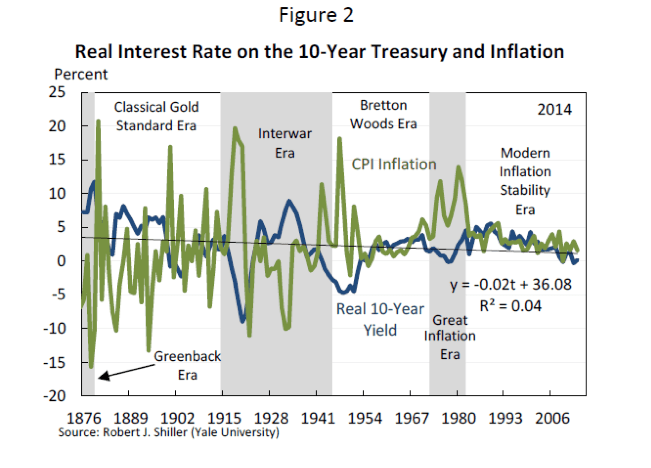

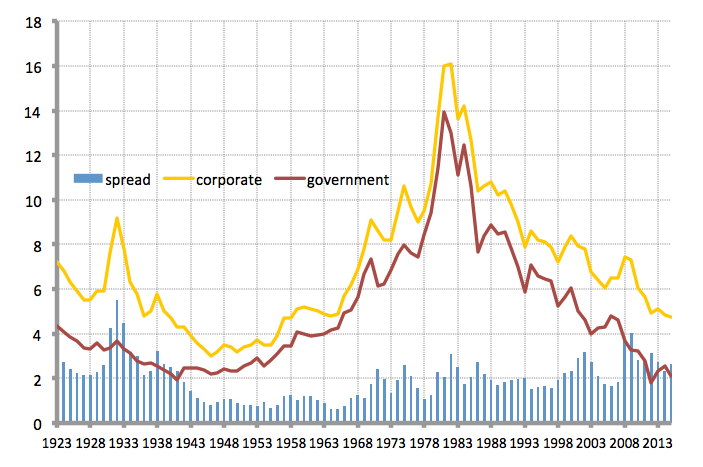

The most important feature of the dynamics of the long rate of interest is not the recent reduction, but the long-standing and severe elevation of rates prior to that reduction. Even now corporate rates have declined only to a level that was the upper end of the norm for the 30 years after the war. The increase in rates came at the start of the 1980s, in the wake of the Volker shock to monetary policy and full capital liberalisation. The latter a disastrously failed action, given it was ostensibly aimed at the reduction of rates. Apparently mystifying but at least recognised by policymakers at the time, [5] high real rates were the norm until the end of the millennium.[6] These rates were:

- basically double the rates of the golden age; and

- broadly equivalent to the rates in the 1920s that preceded the great depression; the average rate over 1923-29 was 5.9 per cent and over 1980-2000 was 7.2 per cent [7].

Accepting the argument that outcomes are determined by real rates, it is hardly surprising that since 1980 the performance of the global economy has in general terms fallen well short relative to the post-World War Two period on nearly all measures, and in terms of stability is not unlike the disastrous events of the inter-war period. This argument will be developed in the next instalment, taking its cue from Keynes’s warning at the head of this document.

One final remark on current rates: in spite of the intensive focus on the extent of reductions in certain rates of interest, it is notable that these have not proceeded as far as they did in the aftermath of the great depression.

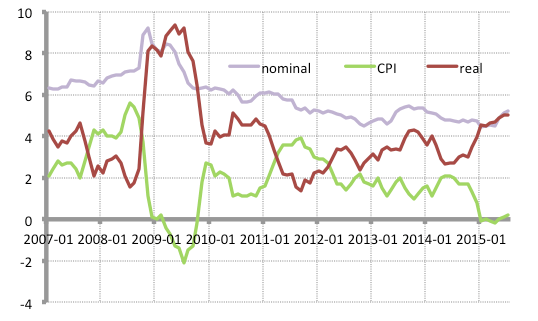

After only four years in in office, Roosevelt had reduced the nominal corporate borrowing rate by around half (chart A). In the meantime he had reflated the economy, so the average real rate over 1934 to 1937 was 2.2 per cent. (Then followed the imposition of a deflationary policy leading to the recession of 1938, but these actions were quickly and decisively reversed.) Over the comparable four-year period today (starting two years after the peak nominal rate of 7.4 per cent in 2008), real rates over 2010-2013 were 3.7 per cent. While nominal corporate rates match that achieved by 1936, the deflationary (or rather at present disinflationary) tendency has not been arrested. The CEA publish their analysis at a time when real rates are rising rapidly, and virtually at a five-year high (a point normally ignored in the deflation debate).[8]

Chart D: Real corporate rate of interest

Given the recognition of the central importance of the long rate to economic outcomes, this analysis suggests a far less benign trajectory of interest rates over the past 30 years and into the present.

References

Allsopp, Christopher and Andrew Glyn (1999) ‘The Assessment: Real Interest Rates’, Oxford Review of Economic Policy, 15 (2), Summer, 1–16.

International Monetary Fund (1985) World Economic Outlook, April 1985, Washington DC: IMF.

[1] ‘How to avoid a slump’, The Times, 12-14 January 1937; Collected Writings, Volume XXI, p. 389.

[2] LONG-TERM INTEREST RATES: A SURVEY, https://www.whitehouse.gov/sites/default/files/docs/interest_rate_report_final.pdf

[3] “The real interest rate is the rate that influences economic activity—ultimately, market participants care about the returns to their saving and investment decisions net of inflation” (p. 3).

[4] Interest rate data are not readily available for most countries, the US is the exception, with long-run figures available from the Federal Reserve website, supplemented with Sidney Homer’s A History of Interest Rates. Government figures are based on Treasury 10 -year bonds, corporate on BAA corporate bonds; both are adjusted with the GDP deflator, with BEA figures supplemented with historical information from Friedman’s monetary history. CEA real-terms figures are based on the CPI, which seems too narrow a measure given the concern with activity across the economy as a whole. But the choice of index does not change any of the results. More generally, while plainly a special case, it is likely that rates on US borrowing underpin rates on borrowing and therefore serve as a proxy for rates across the globe. Though ‘risk’ premia in developing countries in particular may mean rates departing very significantly from the US benchmark. The 2015 figures on both charts are year to date.

[5] From the 1985 IMF World Economic Outlook:

Perhaps the most striking and puzzling feature of monetary conditions in the major industrial countries over the past several years has been the persistence of high real interest rates, on both short-term and long-term financial instruments. These high real rates, which have no historical precedent outside periods of price decline during depressions, have persisted, despite lower inflation and the continued existence of a significant margin of economic slack. The phenomenon is quite widespread. Although real interest rates have differed across the major industrial countries, on the whole there has been less divergence of these rates, especially during 1982–84, than in previous periods. … These measures imply that real interest rates in the major industrial countries during the 1980s have been significantly higher than those that prevailed in the 1950s and early 1960s and even further above those of the 1970s. Real interest rates increased sharply during the period from 1980 to 1982 and then remained at relatively high levels in 1983 and 1984. … The average real short-term interest rate in the major industrial countries in 1980–84 was 5.5 per cent per annum and the average real long-term interest rate was 5.8 per cent. In contrast, average real long-term interest rates for the major industrial countries during the period 1952–65 ranged from roughly 1.5 to slightly over 3 per cent per annum. The contrast is even sharper with the experiences of the late 1970s. During 1976–79, for example, the average real long-term interest rate in the major industrial countries was 0.9 per cent per annum. (pp. 123–4)

[6] At the end of this era, an issue of the Oxford Review of Economic Policy on real rates confirmed:

There is a widespread impression that real interest rates have been very high since 1980 in comparison with post-Second-World-War experience. The data in [Table 11.2] confirm that this is indeed the case. Short-term real interest rates, averaging nearly 4 per cent, have been much higher and a little more stable than between 1950 and 1980. The general picture is confirmed by data on long rates as well. (Allsopp and Glynn, 1999, pp. 3-4)

[7] Using the CPI: 5.9% and 6.4%.

[8] Real figures are derived here using the CPI, given availability of monthly figures.