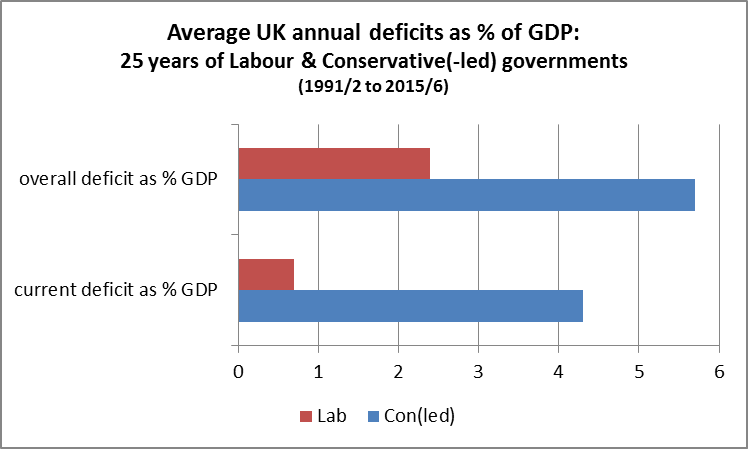

When it comes to current budget spending (i.e. excluding capital investment spending) the Conservative government average is a stunning 4.3%, whilst the Labour government average is just 0.7%. That is, over the whole 13 years of government, including the financial crash, current spending was on average close to balance. This average covers the early post 1997 period when a current surplus was posted in 3 years, but prior to the financial crisis, 2004/05 was the only year in which the current deficit exceeded 1.1% of GDP, at 1.6%. The lowest current deficit under a Conservative government was 1.7% in 1991/2, and since then, never a year under 2%.

In case it is thought that we are being over-hard on the Coalition government that took office in May 2010 and certainly inherited a high deficit, we have also looked at the averages for the same period but excluding the first two years of the Conservative-led Coalition (with overall deficits of 8.6% and 7%). Even taking these years out, the picture hardly changes. This shown here in Chart 2:

One Response

Does any of this take into account the loss of our triple-A credit rating in 2011? Surely that would affect the cost of repayment and increase the deficit for Oddballs?