On the ‘Bank Underground’ website [1], Gene Kindberg-Hanlon makes a most welcome contribution to the evolving debate around real interest rates. Importantly, he dismisses the standard mainstream account of real interest rates conforming to economic growth:

“Global growth was much higher in the 1950s to 1970s than in the 1980s, yet real interest rates were significantly lower on average.” (See also my earlier article for Prime).

And he observes that “The factors thought to account for the majority of the fall in real rates since the 1980s can explain none of the prior rise in real rates to their abnormally high level” (i.e. weaker growth, falling dependency ratio, and fall in the price of consumption goods relative to capital goods).

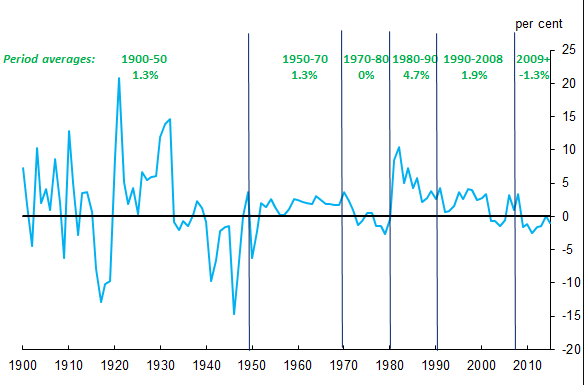

But with the conventional theory dismissed, it is replaced with a theory of real interest rate historical ‘norms’. Departures from norms follow dynamics around inflation and monetary policy responses – with real rates explained by nominal dynamics. The norms and departures are shown on his chart A, reproduced below:

Chart A: US 1 year real interest rates since 1900

The “low” rates of the 1970s were a result of policymakers “accommodating rising inflation in order to secure growth objectives, and interest rates rose less than one-for–one with inflation” in the wake of the “collapse of the Bretton Woods system in 1971”.

Conversely this accommodation ended with “the introduction of the Humphry Hawkins (1978) Act” [2] and “the introduction of Paul Volcker as chairman of the Fed”:

“Real rates increased sharply to restore price stability and anchor expectations in the late 1970s”.

Kindberg-Hanlon recognises “the high initial cost of fighting inflation, with unemployment reaching around 10% and the so-called “Volcker recession” in the early 1980s”.

With the battle against inflation won, norms were restored from the 1990s: “Coinciding with this fall in inflation, real rates began to return to previous averages”.

But the norms were short lived: “Real rates began to fall again to negative levels in 2009, having stabilised in the 1990s and early 2000s”.

This fall is explained as a result of slack (i.e. spare capacity) in the economy that has persisted since the financial crisis. Again this follows from conventional monetary policy doctrine, with low (real?) rates necessary when there is slack. Kindberg-Hanlon recalls Reinhart and Rogoff on economic activity after financial crises to explain the persistence of the slack. ‘Secular stagnation’ is simply dismissed on the grounds that history shows that economies eventually recover.

Discussion

Ultimately the mainstream theory is dismissed and replaced by a theory where real interest rates simply mirror monetary policy actions and are ultimately irrelevant in the greater scheme of things. Real economic outcomes are determined by chance or by processes beyond our ken.

Between the lines, however, there are additional constructive ideas. Approaching the economy from the perspective of real rates of interest leads to the conclusion that there is slack in the economy, when most conventional work concludes the output gap is near zero and so there is no slack. Moreover there is a recognition that sometimes fiscal intervention can be necessary:

“the Great Depression was only ended by rearmament and war”.

(The notion that war has been the only motivating force for expansionary fiscal policy is not only pernicious but also wrong. Fiscal expansion in the UK began decisively in 1934 and in the US with the 1933 New Deal: both were initially concerned with economic and social revival, not war.)

Even more fundamentally, Kindberg-Hanlon also acknowledges Keynes’s relevance to discussions around interest rates:

“During the last period in which economists feared secular stagnation, the 1930s, Keynes argued that the loanable funds framework for interest rate determination, involving the equilibration of ex-ante savings and investment preferences, was flawed. Instead, the interest rate should be regarded as the price of money in exchange for less liquid financial assets (see “the ‘ex-ante’ theory of the rate of interest”).”

While truly valuable, this is a concise account of Keynes’s position, to put it mildly. As early as June 1931 he saw the dear money of the 1920s as the cause of the Great Depression:

“We are today in the middle of the greatest economic catastrophe – the greatest catastrophe due almost entirely to economic causes – of the modern world. … I see no reason to be in the slightest degree doubtful about the initiating causes of the slump … The leading characteristic was an extraordinary willingness to borrow money for the purposes of new real investment at very high rates of interest – rates of interest which were extravagantly high on pre-war standards, rates of interest which have never in the history of the world been earned, I should say, over a period of years over the average of enterprise as a whole. This was a phenomenon which was apparent not, indeed, over the whole world but over a very large part of it.” (CW XIII, pp. 343–5)

Kindberg-Hanlon does not discuss the 1920s, but these rates were also way outside long-standing historic ‘norms’. Through his liquidity preference theory, Keynes came to understand shifts in interest as a matter of changing conventions. But deliberate policy action was required to undo convention: this meant extensive changes to domestic debt management policy as well as to international monetary architecture, not least capital control. Lower rate ‘norms’ were restored in the aftermath of the Great Depression and through the Golden Age. The rise in rates over the 1980s was primarily the result of decisively undoing the mechanisms put in place to hold them low. Higher rates prevailed for longer than suggested on chart A, which has the disadvantage of being based on short maturities for government rather than longer maturities for corporates. The monetary authorities restored conditions that Keynes warned should be avoided as we would ‘hell fire’.

Kindberg-Hanlon is surely right that today’s negative real rates have come merely as a response to the relentless crises of hell-fire. But the global monetary environment today is wildly at odds with the means to genuine cheap money. Moreover, while cheap money may be a necessary condition of recovery, it is not a sufficient one – that is where fiscal expansion comes in. I very much agree that secular stagnation is not an inevitability, but it will not be avoided without a substantive change in policy.

[1] ‘Bank Underground‘ is a blog written by staff at the Bank of England.