This article first appeared in the Indian Journal the Economic & Political Weekly on 12 October 2018

About four years ago, I penned an article in the Economic and Political Weekly titled, “A Sovereign Debt Story: Republic of Argentina vs NML Capital” (EPW, 17 May 2014 ). Many things have happened since then and it is time to write a private debt story now, Turkey’s story.

Turkey and Argentina are twins in the sense that these countries suffered from almost simultaneous financial crises both in 2001 and 2018. Both are currently suffering from currency crises with potential spill-over to the rest of the emerging markets, and there are those who argue that these twins may have triggered a crisis in the emerging markets in 2018.

Although these twins are non-identical for many reasons, the eminent reason appears to be the stances they took then and now. In 2001, Argentina took a hard stand against the International Monetary Fund (IMF), and Turkey surrendered to it. In 2018, Argentina surrendered to the IMF and Turkey, resisting too many internal and external calls for asking for help from the IMF, and hired McKinsey & Company instead.

Turkey before 2001 Crisis

Let me start from 1979, when Turkey went to the IMF for loans after a balance-of-payments crisis and, in exchange for the loans, prepared a “stabilisation” programme approved by the IMF on 24 January 1980. The implementation of the programme was guaranteed by the Turkish military with the coup d’état of 12 September 1980.

This programme and the coup d’état that followed were nothing but the Turkish leg of the so-called “Deng–Volcker-Thatcher–Reagan Revolution” that took place between 1978 and 1980. The economic programme as well as the ideology of this revolution came to be known as neo-liberalism and consists of three main objectives: economic liberalisation, privatisation of state-owned enterprises, and stabilisation of inflation or financial stability as it is called these days.

I will now fast-forward to 1999 and start describing the 2001 crisis in Turkey. But, before doing that, I will mention a significant event: the liberalisation of capital account—full opening of the borders to capital flows—in 1989, presumably to facilitate the financing of public deficits without crowding out private investment.

Turkey’s 2001 Crisis

Then came the South East Asian crisis in 1997, the Brazilian and Russian crises, as well as the Long-Term Capital Management collapse in 1998 and a major earthquake that hit Turkey in 1999, all pushing the Turkish economy into a deep recession. Further, the Turkish banking system was in poor health (eight insolvent banks had to be taken over by the public Savings Deposit Insurance Fund [SDIF]) and relied heavily on government bonds in a high inflation–high interest rate environment, while the government was running a large budget deficit.

In 1999, Turkey started to implement yet another “stabilisation” programme drafted in 1998 under the guidance of the IMF and supported by an IMF stand-by loan of $10.5 billion after further commitments in December 1999. The objectives of this programme were reducing inflation, real interest rates and government borrowing, and the major tool of this disinflation programme was a crawling peg of the Turkish lira.

And, as is now known from many episodes in many countries, any currency peg in any country with large foreign debt, fully open borders to capital flows, and a fragile banking system is a recipe for disaster. The disaster in Turkey occurred in 2001 in two phases: first in February, when the peg was broken, and second in March, when large sums of foreign money left the country. The lira lost about 50% against the dollar ($), the stock market crashed, and interest rates skyrocketed, bringing the government bonds–dependent banking system to a near collapse (eight additional banks had to be taken over by the SDIF in 2001).

In March 2001, the coalition government that came to power in May 1999 recruited a former World Bank Vice President, Kemal Derviş, as the economy tsar. Yet another “stabilisation” programme, also known as the Derviş Programme, was prepared, an agreement was reached with the IMF in May 2001, and the IMF supported the Derviş Programme by an additional standby loan of about $8 billion, bringing the total IMF credit extended since December 1999 to about $19 billion. But, the economic turmoil continued into 2002 and, in April 2002, one of the coalition partners called for an early election that led to the election of November 2002.

AKP, IMF and McKinsey

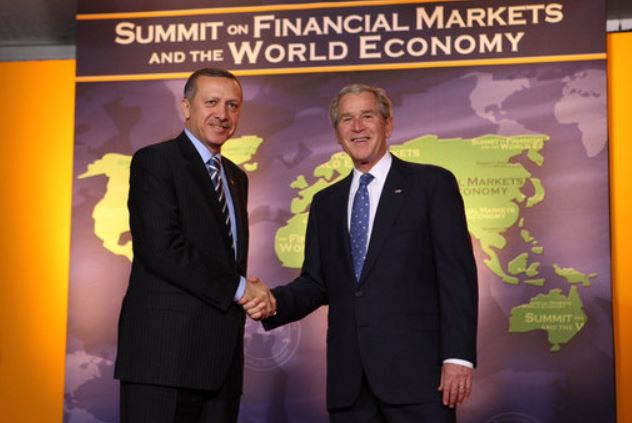

With all other political parties in disarray, an offspring of the Islamist Welfare Party or Refah Partisi (RP), the Justice and Development Party or Adalet ve Kalkınma Partisi (AKP), won the November 2002 early election and has been governing the country since then. The AKP differed from its parent, the RP, in that it claimed to be pro-market and pro-democracy, and was vehemently supported and promoted by the West as Islamic democrat. Let me mention in passing that the AKP eventually dismantled the parliamentarian democracy in 2017 and replaced it with a presidential system with “Turkish characteristics,” as they claim. The AKP’s charismatic leader, Recep Tayyip Erdoğan, is now governing the country from a palace in Ankara single-handedly, and the same West that praised the AKP and Erdoğan as being Islamic democrats then, now liken him to an Ottoman sultan and accuse him of authoritarianism.

With the election victory, the AKP took ownership of the Derviş Programme and followed it through until it expired in February 2005, strictly. The AKP then signed another three-year standby agreement for a $10 billion loan in May 2005 to continue the programme, although deviations started to occur thereafter. Since May 2008, Turkey has not signed any agreement with the IMF, and the AKP paid the last instalment of the IMF loans in 2013, paying a total of $23.5 billion over a decade. Since this has been a matter of pride, and an election as well as propaganda tool for Erdoğan, it is highly unlikely that he would be willing to go to the IMF before the upcoming local elections in March 2019, even if the ongoing currency crisis evolves into a full-blown financial crisis before that.

As for McKinsey & Company, starting from the 1980s, various Turkish governments have hired McKinsey for several purposes. So the AKP’s recent attempt to work with McKinsey is not new in Turkey. The objective is clear. The AKP cannot go to the IMF until March 2019 (unless Erdoğan calls for an early election or suspends elections forever), given the almost no credibility that it is left with at the moment. Therefore, this move has been to gain some credibility in the implementation of the New Economic Programme announced on 20 September 2018 to meet the expectations of the creditors to whom Turkey owes about $467 billion.

Private Debt Build-up

Let us go back to the Derviş Programme the AKP had implemented before it switched to “crony capitalism” around 2007. It was to ensure compliance of the already existing secular capitalists and to create Islamic capitalists to fund its Islamic agenda through rent extraction from public–private partnerships, public procurements, and other privatisations of the commons. Although, this rent extraction existed even before the switch to “crony capitalism.”

The Derviş Programme was an extension of the usual neo-liberal economic programme Turkey had been going through since 1980, but was unable to bring to a conclusion until 2001. The three components of any such programme include: (i) fiscal reforms to “generate savings,” that is, “austerity;” (ii) structural reforms to “enhance competitiveness and growth,” such as privatisation of public assets and deregulation of the markets, including the labour market, that is, “labour market flexibility;” and (iii) financial reforms to “enhance financial stability,” such as central bank independence, prohibition of direct central bank lending to government, bringing inflation under control, opening the borders to capital flows, banking regulations, and bank recapitalisation and resolution mechanisms.

What leads to private debt build-up in any country implementing such reforms is always the austerity component, not to mention the privatisation of public assets because that happens on private debt. Since money is debt and austerity pushes the government to borrow less and less, unless some financial crisis occurs and private debts become public, the onus of increasing the money supply for enhancing “competitiveness and growth” falls on the shoulders of households and non-financial firms by borrowing more and more. This is what happened in Turkey too.

Originally neo-liberal and now crony-capitalist, the AKP economic programme depended on cheap labour, speculative financial capital inflows, and a high trade deficit. The share of industrial production decreased, and the country became increasingly dependent on imports of intermediate and capital goods as well as energy. The construction sector became a major contributor to the domestic income, and many cities around the country look like huge construction sites. Agricultural production is weak and meat production is virtually non-existent. Although one of the main objectives of the 24 January 1980 “stabilisation” programme was a switch from an inward-looking economy to an export-oriented one, the end result in the course of a few decades, especially under the AKP reign, was an import-oriented economy.

Of course, you cannot run such an economy without large foreign currency debts, and if the government is not borrowing, who is going to borrow? Recalling that Turkey’s foreign currency debt is about $467 billion (about 57% of the domestic income), about 80% of this foreign currency debt is private and nearly half of that belongs to the non-financial corporate sector. It should be mentioned that slightly less than half of the non-financial corporate debt is owed to the domestic banks, increasing the fragility of domestic banks because revenues of a big chunk of the borrowers are in domestic currency and the number of firms filing for financial protection is growing by the day.

But, this is only the foreign currency debt. When combined with the domestic debt, total debt of the real sector consisting of households (16%) and non-financial firms (75%) was about 91% of the domestic income as of second quarter of 2018, whereas total debt of the real sector consisting of households (1.8%) and non-financial firms (24.4%) was about 26.2% of the domestic income in 2002, indicating that the growth rates were phenomenal.

What Happens Now?

Turkey has been on a spending spree on credit for about 16 years, enjoying two strong capital tides coming in, one between 2002 and 2008, and the other between mid-2009 and mid-2013.

And, now, the capital tide is going out and it is the payback time. On 6 October 2018, after strong objections to McKinsey from sections of the opposition as well as his electoral base, President Erdoğan said: “I told all my ministers to no longer receive consultancy from McKinsey.” A day later, he also said: “It is out of question for Turkey to cross paths with the IMF. Turkey has closed that chapter forever.”

We will see what happens now.

T. Sabri Öncü ([email protected]) is Chief Economist, Division on Political Economy, Centre for Social Research and Original Thinking, İstanbul, Turkey.