This is Jeremy Smith ‘s contribution on labour productivity to the EREP review of the UK economy 2015, “the Cracks Begin to Show”. The full report can be downloaded here.

The fact that concerns over the UK’s low productivity are still so strong, both as a long-term international trend, and in particular since the financial crisis, speaks volumes about the nature of the UK “recovery”, based as it is on low productivity and lower real wages.

The government is caught on the horns of a dilemma. Should it celebrate the (real but skimpily-remunerated) increase in employment over the last 3 years? Or see this as the result of a dysfunctional low productivity economy, increasingly of its own shaping? Of course, it tries to gloss over their incompatibility.

In July, alongside the post-election budget, the Government issued a report on productivity, “Fixing the foundations: Creating a more prosperous nation” (a mandatory Osbornian building metaphor!). The ministerial Foreword blurs the issues:

Productivity is the challenge of our time. It is what makes nations stronger, and families richer. Growth comes either from more employment, or higher productivity. We have been exceptionally successful in recent times in growing employment. We are proud of that. But now in the work we do across government we need to focus on world-beating productivity, to drive the next phase of our growth and raise living standards.

The Executive Summary says

In every member country of the Organisation for Economic Co-operation and Development (OECD) where average wages are above UK levels, productivity is also higher.

This is certainly true – and says a lot about the UK’s low wage culture and policy – but in several cases, this is because unemployment is also far higher. France (see here for my long comparison with the UK) has roughly the same population and GDP, but a far higher labour productivity – and a chronically higher unemployment rate. So we need to be careful – one can raise productivity without boosting GDP or overall living standards, and without improving the public finances – if there is insufficient aggregate demand.

The Government identifies two pillars for improving productivity – in which the government gives itself no role as “actor”, but merely as hopeful “encourager” of long-term investment, and “promoter” of a “dynamic economy that encourages innovation and helps resources flow to their most productive use”.

And when it gets down to its “fifteen-point plan”, what it mainly does is to recycle and repackage existing government policies based on laissez-faire ideology… and Top of the List:

“An even more competitive tax system, bringing business and investment to Britain… High rates of corporation tax distort incentives and stifle business investment. During the last Parliament the main rate of corporation tax was cut from 28% to 20%”.

This is a very odd priority in this context. For the period during which Corporation Tax has been progressively cut coincides precisely with the period in which labour productivity has been at its lowest! Many higher productivity countries have higher corporation tax rates. This is a pure example of ideology trampling over evidence.

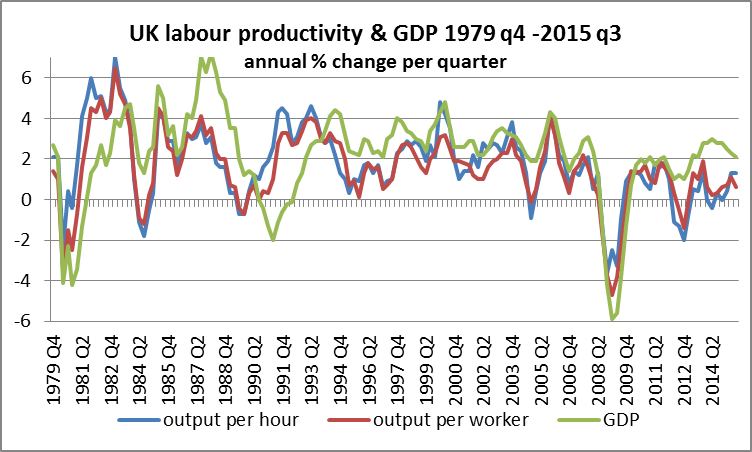

So let’s come to the evidence. We have tracked real GDP and labour productivity since late 1979 to the end of Q2 2015 (at the time of writing, ONS have not published Q3 labour productivity numbers). You will see from the chart that the correlation between GDP and productivity is very strong – when GDP goes up, so does productivity. And when it goes down, so does productivity, sometimes with a slight advance or delay. Increased demand tends to enhance productivity.

Since supply-side measures like better education and training take many years to feed through, and then gradually, we may fairly infer that in the short to medium term, it is demand side factors that are more important. And indeed, the periods of growth in GDP and productivity are (unsurprisingly) also tightly correlated over time with increases in overall investment. Yet the first victim of the post-2010 austerity programme was the government’s capital investment programme – a classic false economy.

The orthodox supply-side consensus is that productivity was improving gradually at a steady rate up to 2007, and has since fallen dramatically for a range of (disputed) factors. Thus Professor Richard Jones, Pro-Vice-Chancellor, Research and Innovation, University of Sheffield (great job title):

“The UK is in the midst of an unprecedented peacetime slowdown in productivity growth. Labour productivity – the economic output produced per hour worked – has, for many decades, grown steadily at 2.3 per cent a year. All that changed in 2007, since when it has stubbornly flatlined.”

“Flat-lined” is an odd word to describe the post 2007 gyrations, including the precipitate fall in productivity at the peak of the crisis as demand and output collapsed. But the chart shows that, from 2007 to 2011, productivity tracked GDP (and vice versa) reasonably closely, but when austerity and the Eurozone crisis kicked in in 2012, GDP slowed (to 1.2%) but productivity declined more sharply.

The two years that diverge somewhat from the norm are 2013 and 2014, when GDP increased at a reasonable overall rate (2.2%, 2.9%) while productivity rose only 0.4% and 0.2% respectively. But in 2015, with somewhat higher real pay finally coming through, and a modest (if slowing) rise in GDP, productivity has also risen after a poor Q1.

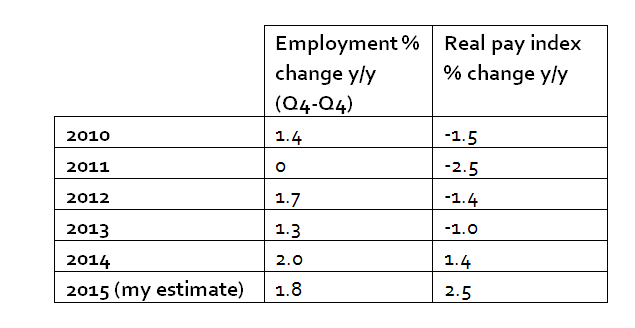

Behind all this, we need to recall that – in real terms – total average pay fell year on year for 6 long consecutive years, a totally new phenomenon since records began, while total employment was rising for most of the time. Only since 2014 has the process been reversed, with real pay starting to rise. As at Q3 2015, however, it still remains an enormous 7.8% below the peak Q1 of 2008.

It is really inescapable that the economy – under the government’s gaze – has evolved, since the financial crisis, in a direction of lower cost, more plentiful labour. Employment growth is concentrated in a range of service sectors (many of which are based on low pay), rather than on industrial production. Table 1 shows how growth in employment and cuts in real pay have come together since 2010 (all data from ONS):

Thus, the ultra-flexible UK labour market (“with employers in the driving seat”, in the government’s own charming words) – to be enhanced by the repressive new Trade Union Act – has had the effect of causing productivity to fall. And whatever government says about wanting higher productivity, this is the necessary consequence of its overall policy stance to date.

One Response

Productivity is likely being impacted by a lot more r and d being amortised software rather than appearing in capex