By Michael Burke

The preliminary estimate of the UK’s 1st quarter GDP showed a rise of 0.5% which exactly matched the rate of contraction in the previous quarter. Consequently over the latest six months the economy has stagnated, registering no growth at all over the period. This follows a 12-month period in which the economy expanded by 2.8%.

A number of commentators, including the Adam Smith Institute have expressed their disbelief at the data. Yet the 0.5% rise was in line with the consensus estimate by economists and, while there may well be revisions to the data in later releases, the average revision over the last five years has been negligible. This refusal to accept reality is a function of adopting an economic framework that does not correspond to reality.

The initial release focuses solely on output measures of growth – income and expenditure measures will follow in May and June. But it is clear from the output data alone that the government policy of cutting investment has been decisive in the stagnation.

When the coalition government took office last year the economic recovery was developing. In mid-2010 the economy expanded by 1.8%. Of this increase 0.3% was accounted for by a rise in manufacturing, which was mainly a function of the pick-up in world trade and the depreciation of the pound. But the biggest contributors to growth were all government-related. Current government spending on services such as health and education directly contributed 0.2% of that growth. The state-supported finance sector contributed another 0.5% and the construction sector contributed 0.6%. Government construction spending both before and during that period led to an increase in private sector investment. Therefore both directly and indirectly, government activity contributed 1.3% of 1.8% growth in mid-2010.

But the effect of coalition policy has been to reverse that increased government spending. Government activity has three effects on GDP; directly, through its own spending; indirectly as its activity causes the private sector to alter its own spending, and an ‘induced’ effect as sectors of the economy not directly related to government activity are affected by changes in spending (for example, consumer spending by workers in firms that supply to government).

When the further date releases are published, it will be possible to analyse this dynamic in greater detail. But it is already clear that government investment fell after the June 2010 Budget and just three months later the economy began to contract. A key area was the fall in government construction spending. The latest data show public construction investment falling by between 13% and 19% from a year ago, depending on the sector. While increased government activity has a triple benefit to the economy, this cut in spending will have had a threefold negative effect on economic activity.

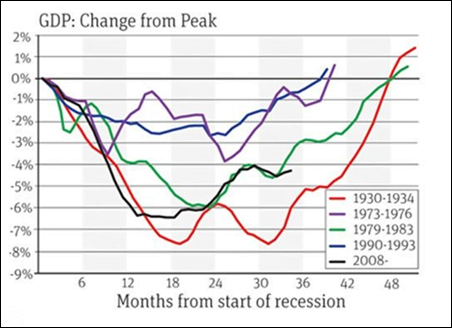

The 1st quarter 2011 data mark three years since the recession began. This should be a period of robust and above trend growth. Instead government policy has produced stagnation. The chart below shows the change in economic activity from the peak prior to recessions.

In this business cycle it is now 36 months since the recession began and the latest data leave the economy still 3.5% below its prior peak. The only cycle where activity was lower at this point was in the Great Depression of the 1930s (-5.2%). The current cycle is more severe than the next sharpest recession during the Thatcher government in the early 1980s, when output was 2.8% lower than the peak level after three years.

In both the downturn of the 1930s and that of the 1980s output was back to its previous peak after four years. This is just one year away in the current cycle and to match that now the economy will have to grow by 3.5% over the next 12 months – which would represent a wholly extraordinary acceleration from present stagnation. Even the Office for Budget Responsibility, which which has tended to give somewhat rosy forecasts, is only forecasting growth at half that rate this year. Anything below 3.5% means that this business slump will exceed even that of the Great Depression, at least in duration although not in severity.

Another deeply worrying aspect of the data is that the economic stagnation arises from £9.4bn in fiscal tightening in the Financial Year just ended, £5.5bn of which was spending reductions. The government plans £41bn of fiscal tightening in the 12 month period beginning in April. The outgoing New Labour government had planned £26bn of fiscal tightening this financial year, £14bn of which was in spending reductions.. Continued support for slower, slightly shallower cuts is, in my judgment, not sustainable given the evident negative impact of much smaller cuts so far.

There is always the possibility of unforeseen events, perhaps a collapse in the currency or a build-up in unwanted inventories either of which might statistically boost GDP without altering the underlying picture of extreme weakness. But outside of these quirks it seems that the best that can be hoped for is a prolonged economic stagnation. A policy-induced return to recession, a ‘double-dip’, cannot be ruled out. It seems certain that employment will fall once more and tax revenues decline. Both of which will lead to a widening of the public sector deficit, contrary to the claims of the government and those who support its economic policies. Instead of these, if we are serious in rescuing the economy, creating employment and reducing the deficit,a complete change of macroeconomic policy is urgently required.

This post originally appeared on the Socialist Economic Bulletin >