A week ago, I argued that in his Autumn Statement, Chancellor George Osborne had played an old-fashioned Con Trick on the British people – luring us into his three-card Monte, playing cards marked ONS, OBR and BoE (Bank of England). Yet he ended up winning – he bags his budget surplus, while we end up with severe cuts implemented a little less visibly and a little more gradually.

Many other commentators have remarked on the reputational risks the OBR has run in its shift to optimism (on GDP, tax receipts, interest..) that happens to coincide with the Chancellor’s political and economic “needs”.

But let’s now examine the card marked BoE a little more closely. In his op-ed in the Financial Times today on the Bank of England, “Monetary policy is impeded and now out of ammunition”, Economics Correspondent Chris Giles argues that

Three times in four weeks, the bank has opted to provide more economic stimulus.

In the second of these three occasions:

..the BoE clarified that it would not begin selling the assets it bought under quantitative easing until it had raised interest rates from rock bottom to 2 per cent. This handed George Osborne an early Christmas gift to spend in the Autumn Statement, since payments on government bonds held by the bank do not count towards the official forecast of net interest payments. The Bank knew as much when it decided to limit its flexibility in this way — so, again, this was a deliberate stimulus. (My emphasis).

The third BoE boost, says Mr Giles, is to be found in its November inflation report, whose forecasts were likely to persuade markets that the Bank would not move on interest rates till at least late 2016. He concludes:

Validating extremely weak market interest rate expectations in this way also directly reduces the official debt interest forecast, giving the chancellor more money — which he duly spent. In total, the BoE’s actions gave Mr Osborne £22.4bn of the £27bn public finances windfall he used to loosen fiscal policy.

Now, it is clear from his article that Chris Giles – who has since 2010 generally supported the government’s austerity policies – is unhappy with what he sees as the Bank’s over-loose monetary policy and with what he sees as a too-close nexus to the Treasury .

I do not share these concerns – especially at this time, when we are assuredly still not in a fully productive, fully active, full-employment economy. But for sure, the timing-plus-content of all this BoE decision-making, and its interpretation by the OBR, was highly convenient for the Chancellor politically. With one leap, he was free from the self-imposed obligation – in the short-term – to compensate by other cuts for his ill-judged cuts to working tax credits, and to avoid cutting unprotected services by astronomical percentages.

But Chris Giles’s analysis underlines my post-Statement view that Mr Osborne’s windfall benefits were as much due to reduced estimates of debt interest payments as to increased assumed tax receipts.

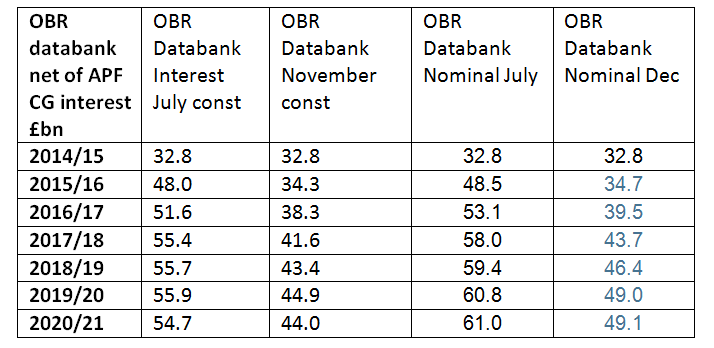

That said, I have to say that in my last blog I over-estimated the benefit from the reductions in interest rate assumptions by the OBR and Chancellor. The figures I used were all absolutely correct figures taken straight from the OBR Databank – but until the Autumn Statement, the Databank post-July (budget) interest numbers for future years were not consistent with the interest numbers in the OBR’s July Economic and Fiscal Outlook report.

What had happened is this – the Databank has a column for central government interest payments “net of APF”, i.e. the Bank of England’s “Asset Purchase Facility” which holds the Bank’s purchases of government debt. For the years up to 2014/15 the figures were indeed “net”, but for later years – despite the column’s clear title – they appear to be the gross figures, i.e. before deducting the government’s interest payments to the Bank/APF.

I am not sure how precisely Chris Giles calculates his figure of £22.4 billion, but in an earlier article (26 November) he indicated that it comes from a mix of assumed lower interest rates (£17bn) plus

the BoE’s unexpected decision in its November inflation report not to sell any gilts until interest rates reached 2 per cent directly gave the chancellor another £5.4bn, according to the OBR.

Looking again at the latest (November) Economic and Fiscal Outlook, Table 4.16 (p.124), in nominal terms, the cumulative direct benefit in lower net interest payment assumptions for the years 2016/7 to 2020/21, between the OBR’s July and November estimates, is £19.2 billion. This is £3.2 bn below Chris Giles’s figure, but still a tidy sum! Since slightly higher borrowing is now envisaged over the period, the underlying interest rate benefit to government is a little higher. The average annual ‘benefit’ is thus about £4 billion.

Going back a year to the estimates in the December 2014 OBR Economic and Fiscal Outlook, the change is even more substantial – with interest in the region of £46 billion (over 2% of GDP) less now assumed (November 2015) for the term of the present 5 year Parliament.

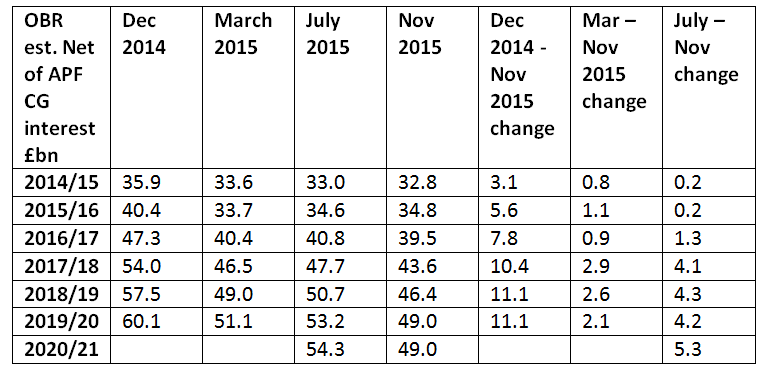

In the Annex to this blog, I include two Tables showing the changes in OBR assumptions on debt interest, with the changes between the different OBR vintages.

However, I must emphasize once more that – even without the favourable debt estimates – there was no economic reason for the Chancellor to make severe further cuts, and least of all to achieve an overall budget surplus. In the UK’s post-war period of maximum economic “growth”, the current (resource) budget was often in balance or surplus but not the overall budget, which includes capital investment in our country’s future.

Mr Osborne had it – and has it – within his power to achieve a balanced current budget (before investment), before the end of this Parliament, without significant cuts. Instead, he has chosen to slow the pace of the cuts, but reach the same destination of a big surplus. and that surplus relies on major public service reductions, and makes poorer families – including working families – much worse off through cuts to Universal Credit.

The OBR and Bank of England have given him economic “cover” by easing his presentational political path. But Mr Osborne and his government are solely responsible for the continuing dismantling of public services and support to families in need.

Annex

In Table 1, I set out the estimated central government (CG) interest payments – net of APF – for present and future years contained in the OBR’s respective Economic and Fiscal Outlook reports of December 2014, and March, July and late November 2015. I then provide the difference for each relevant year between the December to November, March to November, and July to November, reports. Changes between reports are of course due to differences in proposed spending as well as estimated interest rates, but the Table shows the considerable impact of changing estimates in this area.

Table 1

All data from OBR Economic & Fiscal Outlook reports, in current (nominal) prices, and in £ billion